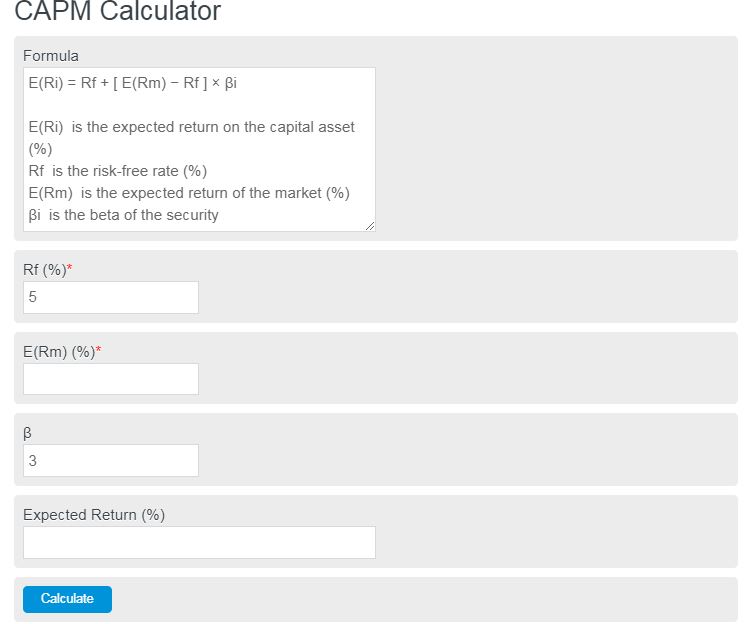

Enter the expected mark return rate, risk-free rate, and Beta for the stock to calculate the return on a capital asset.

- Risk Premium Calculator

- Return on Equity Calculator

- Price Elasticity of Demand Calculator

- Unlevered Beta Calculator

- Levered Beta Calculator

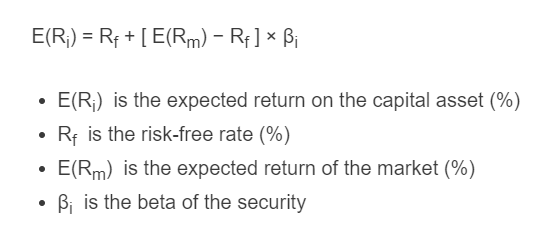

CAPM Formula

The following formula is used by the CAPM to calculate the expected return of an asset or security.

E(Ri) = Rf + [ E(Rm) − Rf ] × βi

- E(Ri) is the expected return on the capital asset (%)

- Rf is the risk-free rate (%)

- E(Rm) is the expected return of the market (%)

- βi is the beta of the security

The beta of the security is another way of saying the risk measure of the security. This will depend on the security, but this averages around a value of 4.

What is CAPM?

The Capital Asset Pricing Model (CAPM) is a financial model used to determine the expected return on investment, considering the level of risk associated with that investment. It provides a framework for calculating the required rate of return based on the risk-free rate, the systematic risk of the investment (measured by beta), and the market risk premium.

The CAPM assumes that investors are rational and risk-averse, seeking to maximize their returns while minimizing risk exposure. It suggests that the return on investment can be explained by the risk-free rate, which represents the return on a riskless asset, and the risk premium, compensates investors for taking on additional risk.

By using the CAPM, investors can evaluate whether an investment is offering a sufficient return based on its level of risk. It is widely used in finance for pricing risky securities, estimating the cost of capital for a firm, and determining the required rate of return for investment projects. However, critics argue that the CAPM has limitations and may not fully capture the complexities of real-world markets.

How to calculate expected return using CAPM

The following example is a step-by-step guide to determining the expected return of a security using the CAPM.

- The first step is to determine what variables we need to know in order to calculate the expected return. Looking at the formula above, you can see that the risk-free rate (%), expected return of the market (%), and the beta must be determined.

- Now, we must determine the risk-free rate of a return on capital. This is often considered things like savings accounts and security bonds. For this example, we will assume a return of 3%.

- Next, the expected return rate of the market must be determined. This is the return rate of the security in the stock market. We will say 10%.

- Next, the beta of the security must be determined. This is a measure of risk. The higher the beta the higher the risk. We will assume a value of 4 for this example.

- Finally, enter all of the information into the calculator or formula. We find the expected rate of return is 31%.

This is a very large return, and the reason it’s so large is mostly because of the beta we chose of 4. The higher the beta the higher the return, but also the higher the risk.

FAQ

What factors influence the risk-free rate used in CAPM calculations?

The risk-free rate is influenced by factors such as government policy, inflation expectations, and the overall economic environment. Typically, it is represented by the yield on government securities, which can fluctuate based on these factors.

How does a change in market conditions affect the expected return calculated using CAPM?

A change in market conditions, such as a shift in the expected market return or a change in the risk-free rate, can significantly affect the expected return on an asset calculated using CAPM. Since CAPM takes into account the market’s overall performance, any fluctuations in market conditions directly impact the expected return.

Can CAPM be used for all types of investments?

CAPM is primarily used for pricing risky securities and estimating the cost of capital for firms. While it provides a useful framework for these purposes, it may not be as effective for investments with unique risk profiles or those not traded in efficient markets.

What are some criticisms of the CAPM model?

Critics argue that CAPM oversimplifies the complexities of real-world markets by assuming that all investors have the same information and are rational and risk-averse. Additionally, the model relies heavily on historical data for beta calculations, which may not accurately predict future risk or returns.