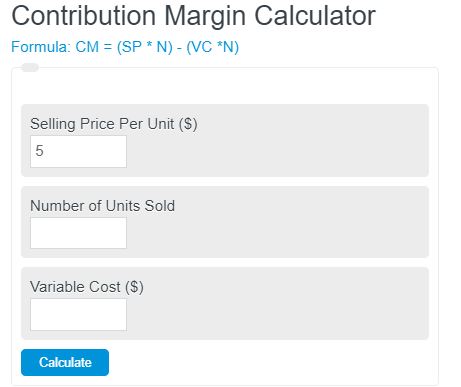

Enter the selling price per unit, variable cost per unit, and the total number of units sold into the contribution margin calculator. The calculator will display the contribution margin amount and ratio in percentage.

- All Margin Calculators

- Break Even Point Calculator

- ROAS Calculator

- Marginal Revenue Calculator

- Operating Margin Calculator

- Contribution Margin Per Machine Hour Calculator

- Percent Contribution Calculator

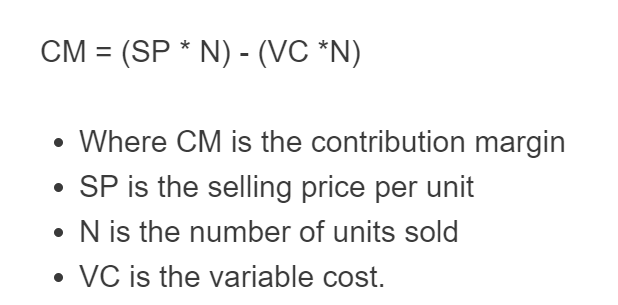

Contribution Margin Formula

The following formula is used to calculate the contribution margin.

CM = (SP * N) - (VC *N)

- Where CM is the contribution margin

- SP is the selling price per unit

- N is the number of units sold

- VC is the variable cost.

To calculate the contribution margin, subtract the product of the variable costs times the number of units sold from the product of the selling price times the number of units sold.

This yields the contribution margin amount. The contribution ratio can then be calculated by dividing the CM by the selling price per unit times the number of units sold.

Contribution Margin Definition

A contribution margin is defined as the difference between the revenue generated by an item and it’s associated variable costs.

How is contribution margin calculated?

Totaling up your cost of goods sold and your variable expenses (i.e., direct labor and overhead), you can calculate your contribution margin as follows:

Contribution Margin = Sales – Cost of Goods Sold – Variable Expenses

Contribution Margin = $10,000 – $7,000 – $3,000

Contribution Margin = $1,000*

What is contribution margin with example?

A contribution margin is a measure of contribution to the overall profit. The contribution margin is calculated by deducting all costs from sales revenue, except those associated with production. The contribution margin can be calculated based on total sales, including all expenses, or it can be calculated based on sales after certain expenses.

What is a contribution margin ratio?

The contribution margin ratio (CMR) is a financial ratio that measures the proportion of revenue available to cover fixed costs and contribute to profit.

Why is contribution margin ratio important?

Contributions margin ratio (also known as gross profit ratio) is one of the most important financial ratios. It measures how profitable a company is with each dollar of sales revenue.

How do you calculate contribution margin ratio?

1. Calculate the contribution margin for each product. To figure this out, divide the cost of goods sold for each product by its selling price. For example, if a product costs you $10 to make and you charge $12, your contribution margin is 25%.

2. Calculate the total contribution margin for each product line by adding up the individual contributions for all products in that line. In this example, there are two products in the line: Product X ($10 / $12) = 83% and Product Y ($15 / $18) = 79%. Total contribution margin = 82%.

3. Calculate the total contribution margin ratio by dividing the total of all contributions you calculated in Step 2 by the total sales revenue from Step 1 (you have to have both numbers to calculate this). Your CMR would be 82% ($2,400/$2,500) in this example.

What is the contribution ratio formula?

The formula for the contribution margin ratio is

Contribution Margin Ratio = Contribution Margin/Net Sales

Why is contribution margin important in healthcare?

Contribution margin is defined as gross profit divided by sales. It is essential to understand contribution margins in healthcare because. It gives you an estimate of how much it will cost to run the practice or hospital. It is also used to evaluate if a particular activity or service should be performed at the facility or if it should be outsourced to a third-party provider.

Why are contribution margins and contribution margin ratios important to you?

The concept of contribution margin allows you to compare the relative profitability of two different products, two different services, two different market segments, or two different distribution channels. This concept also offers a means for evaluating the effectiveness of marketing spending and pricing strategies in achieving profit objectives.

When a firm decides which products to offer or which markets to penetrate, it should examine each product’s contribution margins to determine if it will contribute enough profit to cover its fixed costs. If not, the firm cannot produce that product or not enter that market segment.

If a business has excess capacity and wants to generate more profits, it can increase prices or reduce variable costs per unit sold. Either action will have the effect of increasing the contribution margin for every unit produced and sold. The company can also raise prices on existing products without affecting volume by increasing

Why contribution is important in financial management?

Why you should know your contribution margin:

1) It helps you determine how much money your business generates on every dollar of sales. You can use this information to determine whether your business is profitable or not and whether it is growing or not (if your contribution margin percentage changes).

2) You can use contribution margins to reduce costs associated with different services offered by your business and make decisions like outsourcing medical transcription, radiology, and laboratory services. This will help you know where to focus your efforts to increase profits.

3) You can use contribution margins for setting prices for different services offered by your business. This will help you establish fair prices that are attractive for patients and cover the cost of providing care.

4) You can use contribution margins for understanding the potential impact of new rules and regulations on your business, including changes in reimbursement rates from Medicare and Medicaid and new laws such as HIPAA.

What is contribution per sales ratio?

The contribution per sales ratio is a metric used by retail businesses to determine how much money they will make from each product that they sell. It is calculated as the profit made from a single sale. The formula for calculating this is:

Contribution/Sales = (Gross Profit/Sale) – Cost of Goods Sold

Example:

If you sell a product for $100, and it costs you $75 to make, your contribution per sales ratio would be: ( $25 / $100 ) – $75 = 25%

This means that if you sell 10 products, your total contribution would be $250. If your cost of goods sold was also $250, then you would achieve 100% contribution per sales ratio on that item.

How do you interpret contribution margin ratio?

Contribution Margin Ratio (CMR) is a measurement tool found on a company’s income statement and its balance sheet. The CMR indicates the amount of income a company has left over after all its expenses have been paid. This tool is essential in helping to determine how much money is available for distribution to owners as dividends and how much money is available for reinvestment in the company.

What does a contribution ratio tell us?

The contribution ratio is a measurement of your overall financial health. It’s calculated by dividing your net income by your total expenses.

A high contribution ratio tells us that you’re earning enough to pay for all your expenses, with extra leftover for savings, investments, and other goals. A low ratio indicates that you may be spending more than you earn, leaving you with no money for savings.