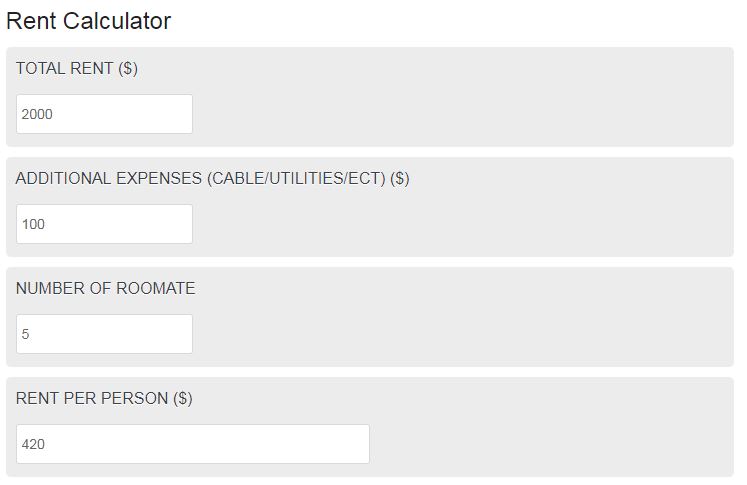

Calculator your monthly rent per person for your upcoming lease or mortgage. Enter your total rent, utility cost, and the number of roommates.

- Net Effective Rent Calculator

- Annual Income Calculator

- Effective Annual Yield Calculator

- Rent Increase Calculator

- ADR (Average Daily Rate) Calculator

Rent Calculator Affordability

The rent calculator above can certainly help you evenly distribute the cost of living in an apartment or home with multiple roommates, but it might not help you decide how much you can afford.

So how much can you afford?

That depends on a few different circumstances. First, how much income you make is usually the number 1 deciding factor. The typical recommendation is that you spend no more than 35% of your take-home pay on rent or mortgage.

For example, if you bring home $3000.00 per month (after taxes, insurance, and retirement) then you should not spend more than $1050.00 monthly on housing, and that is the upper limit. This includes utility etc.

The next deciding factor on how much you can afford is typically the location of your new home with relation to work. For instance, if you are moving far away from work, you must take into account the added expenses of gas for commuting and the cost of maintaining a car that is going to have a lot of miles on it. If you are moving closer to work, this may push your monthly budget up slightly.

Lastly, use your own budget to guide your decision. Everyone’s budget is different, and if you take a single quote like “35% of take-home pay” without considering your individual circumstances, you may end up in an unfavorable situation for the term of your lease.

Calculator Rent vs Buy

Should you rent or buy an apartment?

For most young people, renting is the go-to option. It’s less involved than buying, and it takes little to no upfront cost. With that said, it’s important to understand that when you rent, all of your money you spend is going solely into allowing you to live in that establishment and is gone afterward. When you buy, that money is also going into an investment you can later sell.

The easy answer is if you have enough capital for a down payment, and enough time for all of the paperwork, buying is always preferred from a financial standpoint.

Rent vs Lease

Renting and leasing are essentially the same things, but the terms are used in different contexts and situations.

Leasing is an agreement between two groups of people to allow the use of an asset for an extended period of time, usually over 1 year in the time frame.

Renting is the monthly payment made to the party that owns the property in the lease agreement. Typically used in housing, these agreements are usually 1 year or less.

Rent Calculator Income

As mentioned above, the total rent you can afford is mostly based on your income. Using your monthly take-home pay as a guide to choosing where to live is the first step.

Do not spend more than 35% of your monthly take-home pay on rent for housing unless you have little other expenses.