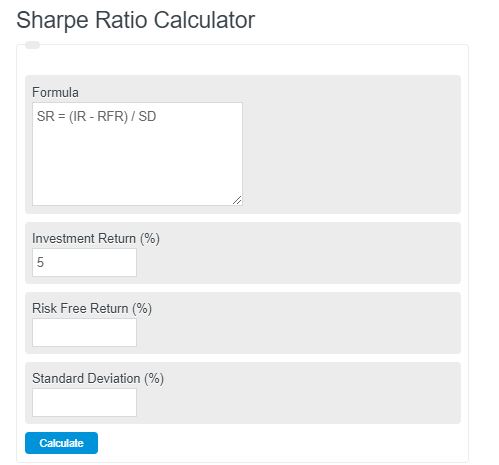

Enter your investment return, risk-free rate, and the standard deviation of the portfolio to calculate the Sharpe ratio of the portfolio.

- Risk Premium Calculator

- Default Risk Premium Calculator

- ROI Calculator – Return on Investment

- Risk-Adjusted Return Calculator

Sharpe Ratio Formula

The following formula can be used to calculate the Sharpe ratio of an investment.

SR = (IR - RFR) / SD

- Where SR is the Sharpe ratio

- IR is the investment return

- RFR is the risk-free return

- SD is the standard deviation

To calculate the shape ratio, subtract the risk-free return from the investment return, then divide it by the standard deviation.

Sharpe Ratio Definition

The Sharpe Ratio is a widely used financial metric that helps investors evaluate the risk-adjusted return of an investment or portfolio. It measures how well an investment has performed relative to the level of risk taken.

The ratio is calculated by taking the excess return of the investment over the risk-free rate and dividing it by the standard deviation of the investment’s returns. The return on a government bond or a similar low-risk investment typically represents the risk-free rate.

FAQ

What is the risk-free rate in the context of the Sharpe Ratio?

The risk-free rate refers to the return of an investment with zero risk, such as the return on a government bond. In the Sharpe Ratio calculation, it represents the baseline return against which the performance of the investment is compared.

How does standard deviation influence the Sharpe Ratio?

Standard deviation measures the volatility or risk associated with the investment’s returns. A higher standard deviation indicates higher risk. In the Sharpe Ratio, it is used as the denominator, so an investment with a higher standard deviation must generate higher excess returns to maintain a high Sharpe Ratio.

Can the Sharpe Ratio be negative, and what does it signify?

Yes, the Sharpe Ratio can be negative. A negative Sharpe Ratio indicates that the investment’s return is less than the risk-free rate, suggesting that it would have been better to invest in a risk-free asset.

Is a higher Sharpe Ratio always better?

Generally, a higher Sharpe Ratio is considered better as it indicates that the investment has generated higher returns for each unit of risk taken. However, investors should also consider other factors and metrics before making investment decisions, as the Sharpe Ratio alone does not capture all aspects of investment performance.