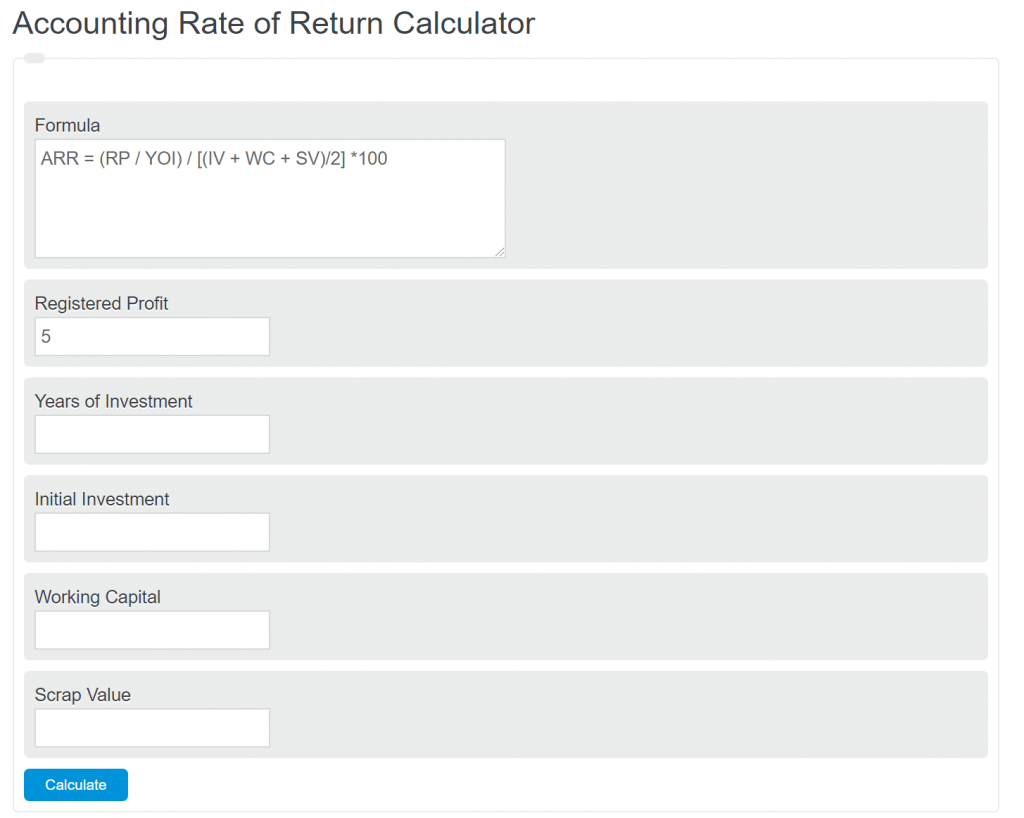

Enter the total profit registered, years of investment, initial investment, working capital, and scrap value into the calculator. The calculator will determine the accounting rate of return.

- Accounting Profit Calculator

- ROI Calculator – Return on Investment

- Profitability Index Calculator

- Expected Rate of Return Calculator

Accounting Rate of Return Formula

The following formula is used to calculate the accounting rate of return of an asset or business.

ARR = (RP / YOI) / [(IV + WC + SV)/2] *100

- Where ARR is the accounting rate of return (%)

- RP is the registered profit

- YOI is the years of investment

- IV is the initial investment

- WC is the working capital

- SV is the scrap value

Accounting Rate of Return Definition

An accounting rate of return is a measure of how profitable any given investment is. It’s more in depth than a typical ROI formula, as it takes into account working capital and scrap value. The higher the ARR the better the investment in 99% of cases.

Accounting Rate of Return Example

How to calculate accounting rate of return?

- First, determine the registered profit.

Measure the registered profit.

- Next, determine the years of investment.

Determine the total years of the investment.

- Next, determine the initial investment.

Calculate the value of the initial investment.

- Next, determine the working capital.

Calculate the total working capital of the business.

- Next, determine the scrap value.

Calculate the scrap value of the assets in the business.

- Finally, calculate the accounting rate of return.

Using the formula above, calculate the ARR.

Frequently Asked Questions

The Accounting Rate of Return (ARR) is a more in-depth measure of an investment’s profitability than Return on Investment (ROI). ARR takes into account not only the registered profit but also factors such as the initial investment, working capital, and scrap value of the assets, while ROI focuses on the return on the initial investment only.

A higher ARR generally indicates a better investment. However, there isn’t a universal threshold to determine a “good” ARR, as it can vary depending on the industry, company size, and investment goals. Investors should consider comparing the ARR of multiple investment opportunities within a similar context to determine which one is more attractive.

Yes, ARR can be negative if the registered profit is negative, which indicates that the investment is generating a loss rather than a profit. A negative ARR implies that the investment is not financially viable and may need further evaluation or reconsideration.

Working capital represents the funds required to keep the business running, including current assets and current liabilities. In the ARR calculation, working capital is added to the initial investment and scrap value, providing a more comprehensive view of the resources invested in the business. A higher working capital can lower the ARR, while a lower working capital can result in a higher ARR, assuming other factors remain constant.

Scrap value is the estimated value of an asset at the end of its useful life. Including scrap value in the ARR calculation provides a more accurate representation of the investment’s overall profitability, as it accounts for the residual value of the assets after their useful life. Ignoring scrap value can lead to an overestimation or underestimation of the investment’s profitability, depending on the assets involved.