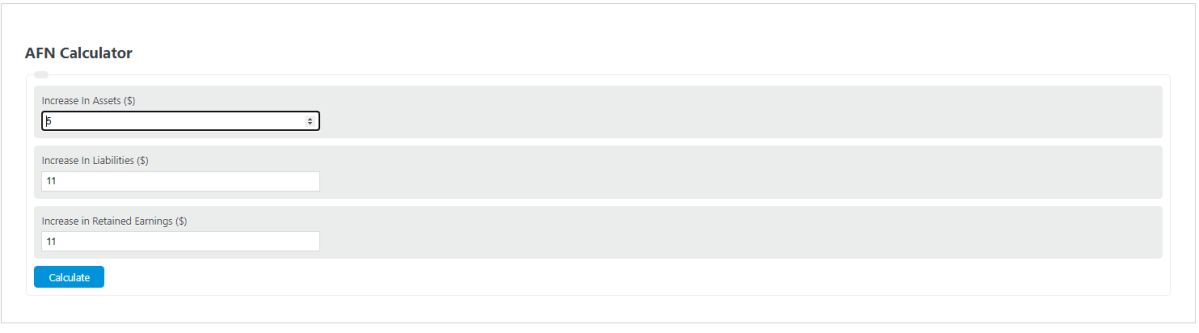

Enter the projected increase in assets, spontaneous increase in liabilities, and increase in retained earnings to determine the AFN.

- Indirect Costs Calculator

- Budget Variance Calculator

- Cost of Capital Calculator

- Projected Sales Calculator

- Cost of Funds Calculator

- Return on Hedge Funds Calculator

AFN Formula

The following formula is used to calculate the additional funds needed.

AFN = IA - IL - IRE

- Where AFN is the additional funds needed ($)

- IA is the increase in assets ($)

- IL is the increase in liabilities ($)

- IRE is the increase in retained earnings ($)

To calculate additional funds needed subtract the increase in liabilities and increase in retained earnings from the increase in assets.

AFN Definition

What is AFN?

AFN stands for additional funds needed. It is a term used in business and finance to describe the additional resources (“funds”) needed for a company to expand it’s operations to hand increases in assets.

At it’s core, AFN is a way of understanding how liabilities will grow relative to assets and sales.

When computinjg AFN, if the value is negative, then the project should generate extra income for the company.

Example Problem

How to calculate AFN?

- First, determine the expected increase in assets.

For this example, the total increase in asssets is expected to be $50,000.00

- Next, determine the expected increase in liabilities.

The total increase in liabilities is found to be $20,000.00 for this project.

- Next, determine the increase in retained earnings.

The retained earnings will increase by $40,000.00 if this project is implemented.

- Finally, calculat the additiona funds needed for the operations.

Using the formula above, the AFN is calculated to be:

AFN = IA – IL – IR

AFN = $50,000 – $20,000 – $40,000

AFN = -$10,000.00