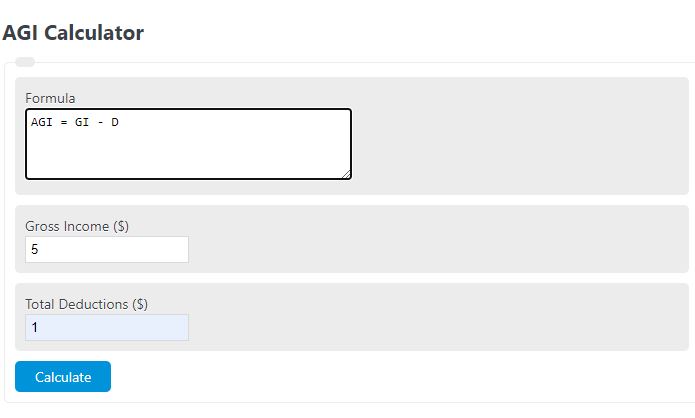

Enter your total gross income, and the total deductions are taken into the calculator to determine your AGI.

- Disposable Income Calculator

- Debt to Income Ratio Calculator

- Gross to Net Calculator

- Annual Income Calculator

- AMT (Alternative Minimum Tax) Calculator

AGI Formula

The following formula is used to calculate an adjusted gross income.

AGI = GI - D

- Where AGI is your adjusted gross income ($)

- GI is your total gross income ($)

- D is your total deductions take ($)

To calculate the adjusted gross income, subtract the deductions from the gross income.

AGI (Adjusted Gross Income) Definition

AGI, or Adjusted Gross Income, is a crucial financial term that summarizes an individual’s total income for tax purposes. It represents the total money a person earns from various sources minus specific deductions and adjustments.

Understanding AGI is importajt for several reasons. Firstly, it determines an individual’s eligibility for various tax benefits and credits. Many tax credits and deductions are income-based, which is phased out or reduced as AGI increases.

By knowing their AGI, individuals can determine whether they qualify for the Child Tax Credit, Earned Income Tax Credit, or the American Opportunity Credit for education expenses.

Secondly, AGI is used as a basis for calculating taxable income. Once AGI is determined, taxpayers can further reduce their taxable income by either claiming the standard deduction or itemizing their deductions if they exceed the standard deduction amount. This ultimately determines the amount of income that is subject to federal and state income taxes.

Additionally, AGI serves as a measure of an individual’s financial standing and is often required for various financial applications.

It is used by lenders, landlords, and other financial institutions to assess creditworthiness, determine loan eligibility, or establish rental agreements.

AGI Example

How to calculate ADI?

- First, determine your total gross income.

Determine your total gross income. This is your total income before taxes and deductions.

- Next, determine your total deductions.

Determine the total amount of deductions. These are pre-tax deductions such as health care and dental.

- Finally, calculate your AGI.

Subtract the total deductions from your total gross income to determine your AGI.

FAQ

What deductions can be taken from gross income to calculate AGI?

Deductions that can be taken from gross income to calculate AGI include certain business expenses, health savings account contributions, certain retirement plan contributions, alimony payments (for agreements made before 2019), and education expenses, among others.

How does AGI affect tax bracket determination?

Your AGI is used to determine your tax bracket. The higher your AGI, the higher the tax bracket you may fall into. Tax brackets are set ranges of income taxed at specific rates, which progressively increase as income rises.

Can AGI impact eligibility for government benefits?

Yes, AGI can impact eligibility for certain government benefits and tax credits, such as the Earned Income Tax Credit, Child Tax Credit, and eligibility for certain types of financial aid for education.

Is it possible to reduce your AGI, and if so, how?

Yes, it’s possible to reduce your AGI by increasing deductions such as making contributions to retirement accounts (e.g., 401(k), IRA), using health savings accounts (HSAs), incurring certain business expenses if self-employed, and other eligible deductions. Reducing your AGI can lower your taxable income and potentially your tax liability.