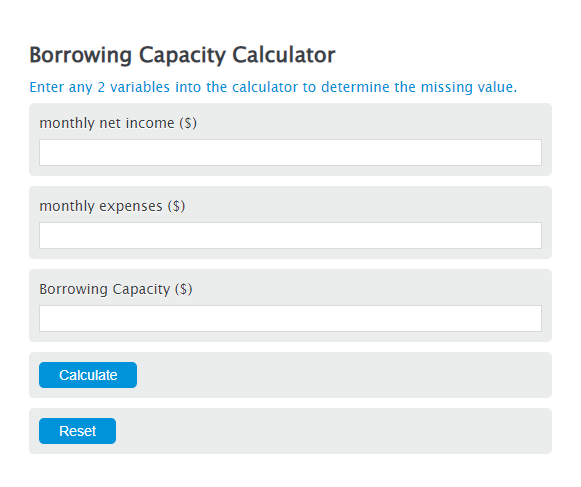

Enter the monthly net income ($) and the monthly expenses ($) into the Calculator. The calculator will evaluate the Borrowing Capacity.

- Debt to Limit Ratio Calculator

- Mortgage Service Ratio Calculator

- Mortgage to Income Ratio Calculator

Borrowing Capacity Formula

BC = NI - E

Variables:

- BC is the Borrowing Capacity ($)

- NI is the monthly net income ($)

- L is the monthly expenses ($)

To calculate Borrowing Capacity, simply subtract the person’s monthly expenses from their net income after taxes.

How to Calculate Borrowing Capacity?

The following steps outline how to calculate the Borrowing Capacity.

- First, determine the monthly net income ($).

- Next, determine the monthly expenses ($).

- Next, gather the formula from above = BC = NI – E.

- Finally, calculate the Borrowing Capacity.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

monthly net income ($) = 9000

monthly expenses ($) = 4000

Frequently Asked Questions

What influences my borrowing capacity?

Your borrowing capacity is influenced by several factors including your monthly net income, your monthly expenses, other financial obligations (such as existing loans or credit card debt), and your credit score. Lenders also consider your employment stability and the type of loan you are applying for.

Can improving my credit score affect my borrowing capacity?

Yes, improving your credit score can significantly affect your borrowing capacity. A higher credit score indicates to lenders that you are a lower-risk borrower, which can lead to them offering you larger loans or loans with more favorable terms and interest rates.

How can I reduce my monthly expenses to increase my borrowing capacity?

Reducing your monthly expenses can be achieved by budgeting and cutting back on non-essential spending, refinancing existing loans to lower interest rates, or consolidating debts to reduce monthly payments. These steps can increase your net income, thereby increasing your borrowing capacity.

Is it possible to calculate borrowing capacity for different types of loans?

Yes, borrowing capacity can vary significantly between different types of loans such as personal loans, home mortgages, or auto loans. Each type of loan has different criteria and factors that lenders use to assess your borrowing capacity. It’s important to use a specific calculator or formula tailored to the type of loan you are considering.