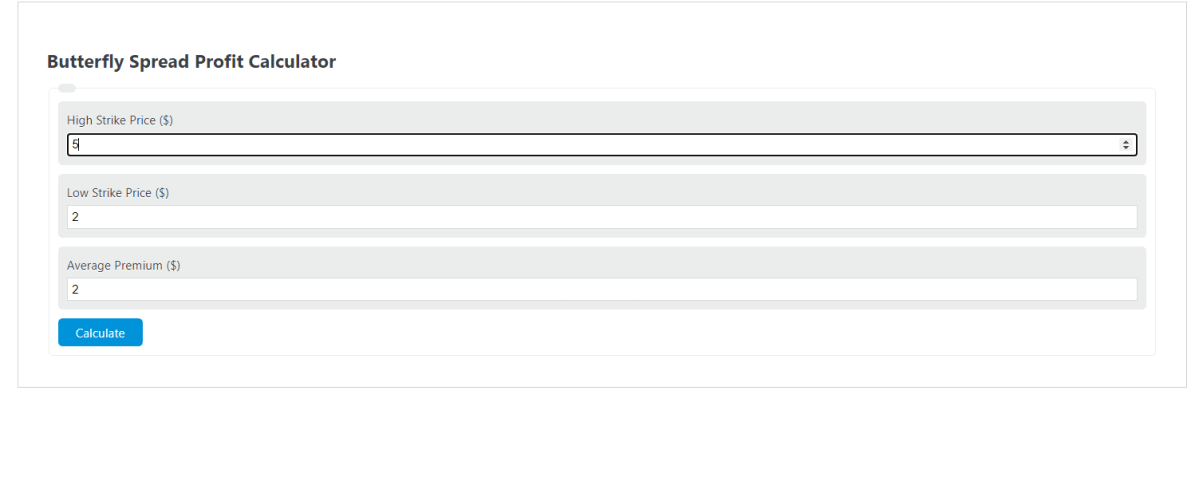

Enter the higher strike price, lower strike price, and premium into the calculator to determine the butterfly spread maximum profit per option.

- Option Delta Calculator

- Conversion Parity Price Calculator

- Average Cost Basis Calculator

- Reverse Stock Split Calculator

- Return on Options Calculator

Butterfly Spread Profit Formula

The following formula is used to calculate the maximum profit of a butterfly spread.

MP = HS - LS - P

- Where MP is the maximum profit per contract ($)

- HS is the higher strike price ($)

- LS is the lower strike price ($)

- P is the premium paid ($)

To calculate the butterfly spread profit, subtract the lower strike price and the premium from the highest strike price.

What is a butterfly spread?

Definition:

A butterfly spread is a financial strategy that combines both bull and bear spreads together to create an investment that has a fixed risk but also a maximum profit.

How to calculate butterfly spread profit?

Example Problem:

The following example outlines how to calculate the maximum profit of a long butterfly spread.

First, determine the lowest strike price. In this example, the low strike price is $5.00.

Next, determine the higher strike price. The highest strike price in this spread is $12.50.

Next, determine the average premium paid. The average premium for this problem is $2.00.

Finally, calculate the maximum profit per contract using the formula above:

MP = HS – LS – P

MP = 12.50 – 5.00 – 2.00

MP = $5.50.00