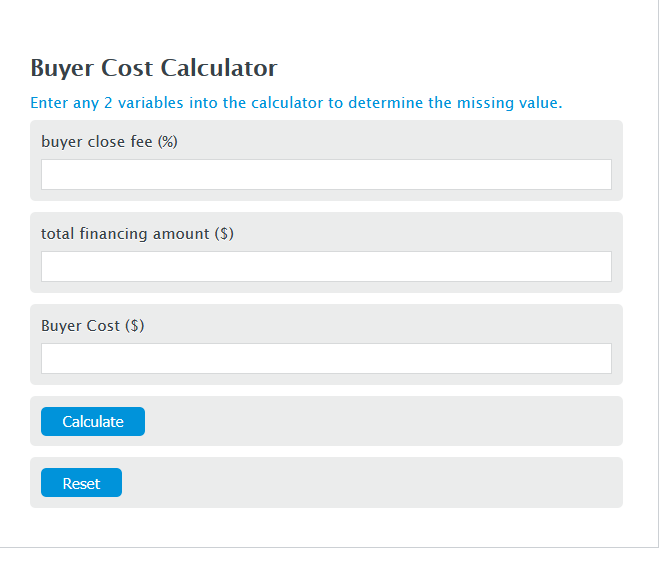

Enter the buyer close fee (%) and the total financing amount ($) into the Calculator. The calculator will evaluate the Buyer Cost.

Buyer Cost Formula

BYC = CFC/100 * FA

Variables:

- BYC is the Buyer Cost ($)

- CFC is the buyer close fee (%)

- FA is the total financing amount ($)

To calculate Buyer Costs, divide the buyer close percentage rate by 100, then multiply by the total financing amount.

How to Calculate Buyer Cost?

The following steps outline how to calculate the Buyer Cost.

- First, determine the buyer close fee (%).

- Next, determine the total financing amount ($).

- Next, gather the formula from above = BYC = CFC/100 * FA.

- Finally, calculate the Buyer Cost.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

buyer close fee (%) = 2.5

total financing amount ($) = 500000

FAQs

What is a buyer close fee?

A buyer close fee, often referred to as closing costs, includes various fees charged to the buyer of a property by lenders and third parties related to the purchase of the home. These costs can include loan origination fees, appraisal fees, title searches, title insurance, surveys, taxes, deed-recording fees, and credit report charges.

Why is it important to calculate Buyer Cost?

Calculating Buyer Cost is crucial for prospective homebuyers to understand the total amount of money needed to finalize the purchase of a property. Knowing this cost upfront helps in budgeting and ensures that buyers are financially prepared for all expenses involved in the home buying process.

Can the buyer close fee percentage vary, and what factors influence it?

Yes, the buyer close fee percentage can vary significantly depending on several factors including the location of the property, the type of loan, the lender’s requirements, and negotiations between the buyer and seller. Some fees may be fixed, while others can vary based on the property’s sale price or the loan amount.

Are there ways to reduce Buyer Costs?

Yes, there are several strategies to reduce Buyer Costs. Buyers can shop around and compare fees from different lenders, negotiate with the seller to pay some of the closing costs, or choose a no-closing-cost mortgage, which typically involves paying a higher interest rate in exchange for the lender covering the closing costs.