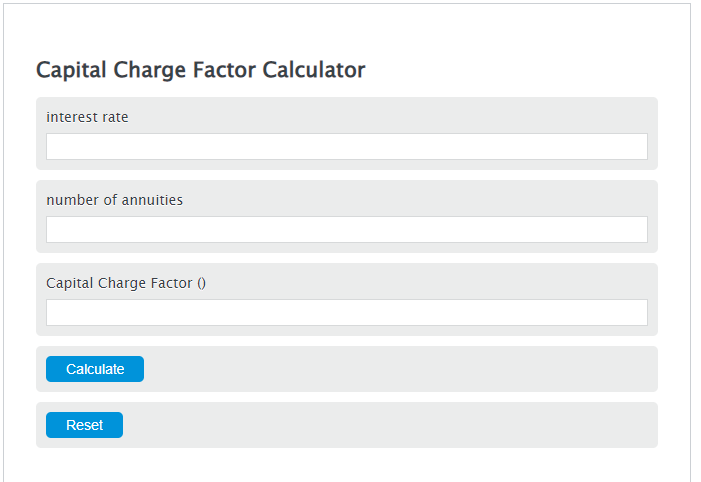

Enter the interest rate and the number of annuities into the Calculator. The calculator will evaluate the Capital Charge Factor.

Capital Charge Factor Formula

CRF = [i(1+i)^n]/[(1+i)^n-1]

Variables:

- CRF is the Capital Charge Factor ()

- i is the interest rate

- n is the number of annuities

How to Calculate Capital Charge Factor?

The following steps outline how to calculate the Capital Charge Factor.

- First, determine the interest rate.

- Next, determine the number of annuities.

- Next, gather the formula from above = CRF = [i(1+i)^n]/[(1+i)^n-1].

- Finally, calculate the Capital Charge Factor.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

interest rate = 0.23

number of annuities = 600

FAQs about Capital Charge Factor

What is the significance of the Capital Charge Factor in financial analysis?

The Capital Charge Factor (CRF) is crucial in financial analysis as it helps in determining the value of cash flows over time, considering the interest rate and the time period. It is used to assess the profitability of investments or projects by calculating the charge for using capital over a certain period.

How does the interest rate affect the Capital Charge Factor?

The interest rate directly impacts the Capital Charge Factor. A higher interest rate increases the CRF, indicating a higher cost of capital. Conversely, a lower interest rate results in a lower CRF, signifying a lower cost of capital. It reflects the relationship between the cost of borrowing and the time value of money.

Can the Capital Charge Factor be negative?

No, the Capital Charge Factor cannot be negative. Since it is derived from the interest rate and the number of periods, both of which are positive values, the CRF represents a positive charge or cost associated with capital over time.

Is the Capital Charge Factor applicable to all types of investments?

While the Capital Charge Factor is a useful tool in evaluating the cost of capital for various investments, its applicability might vary depending on the nature of the investment, the expected cash flows, and the specific financial model being used. It is most effective for investments with regular, periodic cash flows, such as annuities or loans.