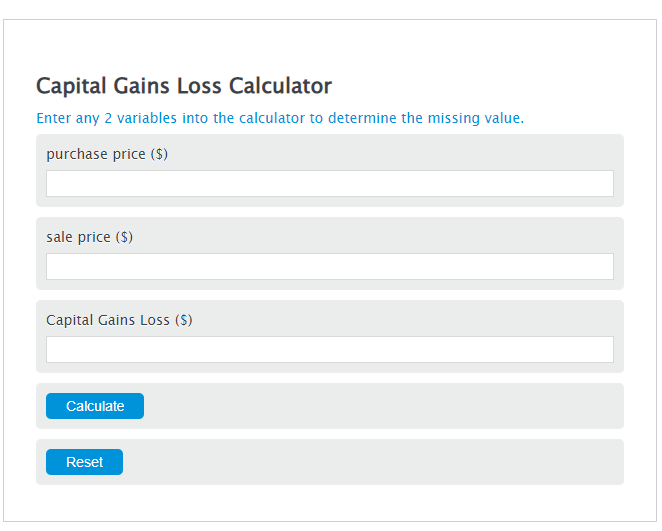

Enter the purchase price ($) and the sale price ($) into the Calculator. The calculator will evaluate the Capital Gains Loss.

- Capital Gains Yield Calculator + Formula

- Net Capital Spending Calculator

- Return On Invested Capital Calculator

Capital Gains Loss Formula

CPL = PP - SP

Variables:

- CPL is the Capital Gains Loss ($)

- PP is the purchase price ($)

- SP is the sale price ($)

To calculate Capital Gains Loss, subtract the sale price from the purchase price.

How to Calculate Capital Gains Loss?

The following steps outline how to calculate the Capital Gains Loss.

- First, determine the purchase price ($).

- Next, determine the sale price ($).

- Next, gather the formula from above = CPL = PP – SP.

- Finally, calculate the Capital Gains Loss.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

purchase price ($) = 2340

sale price ($) = 234

FAQs about Capital Gains Loss

What is Capital Gains Loss?

Capital Gains Loss occurs when the sale price of an asset is lower than its purchase price, resulting in a financial loss for the seller.

How does Capital Gains Loss affect taxes?

Capital Gains Loss can often be used to offset other capital gains or income, potentially reducing the taxpayer’s overall tax liability. However, tax regulations vary by country, so it’s advisable to consult with a tax professional.

Can Capital Gains Loss be carried over to future tax years?

In many jurisdictions, if your total net capital loss exceeds the limit of capital loss deduction for the year, you can carry over the unused part to the next year and treat it as if you incurred it in that next year. This process can continue until the loss is fully deducted.

Are there different types of capital assets?

Yes, capital assets include stocks, bonds, real estate properties, and other investments. The treatment of Capital Gains Loss may vary depending on the type of asset and the duration for which it was held before being sold.