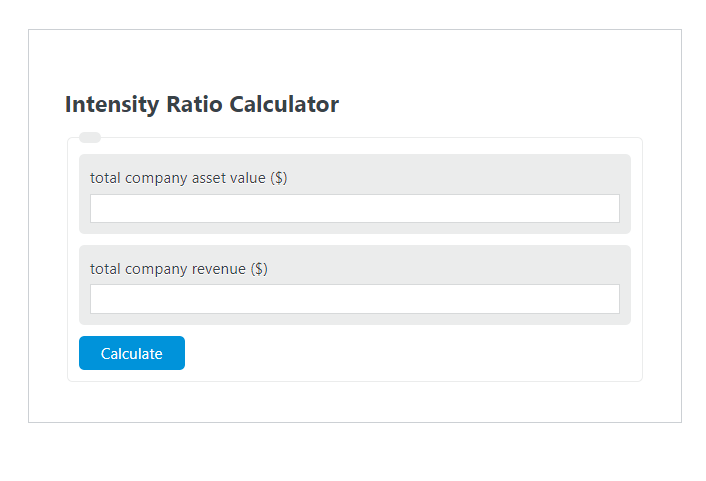

Enter the total company asset value ($) and the total company revenue ($) into the Capital Intensity Ratio Calculator. The calculator will evaluate and display the Capital Intensity Ratio.

- All Ratio Calculators

- Debt to Capital Ratio Calculator

- Working Capital Ratio Calculator

- Profit-Sharing Ratio Calculator

Capital Intensity Ratio Formula

The following formula is used to calculate the Capital Intensity Ratio.

CIR = AV / R * 100

- Where CIR is the Capital Intensity Ratio (%)

- AV is the total company asset value ($)

- R is the total company revenue ($)

To calculate the capital intensity ratio, divide the company asset value by the company revenue.

How to Calculate Capital Intensity Ratio?

The following example problems outline how to calculate Capital Intensity Ratio.

Example Problem #1:

- First, determine the total company asset value ($).

- The total company asset value ($) is given as: 3,000.

- Next, determine the total company revenue ($).

- The total company revenue ($) is provided as: 6,000.

- Finally, calculate the Capital Intensity Ratio using the equation above:

CIR = AV / R * 100

The values given above are inserted into the equation below and the solution is calculated:

CIR = 3,000 / 6,000 * 100 = 50.00 (%)

FAQ

What is the significance of the Capital Intensity Ratio in business analysis?

The Capital Intensity Ratio (CIR) is significant in business analysis as it helps to determine the amount of capital that is being invested in order to generate revenue. A higher CIR indicates that a company is investing more in assets to generate revenue, which can be a sign of a capital-intensive business. Understanding the CIR can help investors and analysts assess a company’s operational efficiency and its reliance on physical assets for income generation.

How can companies use the Capital Intensity Ratio to improve their financial performance?

Companies can use the Capital Intensity Ratio as a metric to evaluate their efficiency in using assets to generate revenue. By analyzing this ratio over time, companies can identify trends and make strategic decisions to optimize their asset utilization. For instance, if a company’s CIR is increasing, it may look into ways to streamline operations or invest in more efficient technologies to reduce capital intensity and improve profitability.

Can the Capital Intensity Ratio vary by industry?

Yes, the Capital Intensity Ratio can vary significantly by industry due to the differing nature of operations and asset requirements. Industries such as manufacturing, utilities, and telecommunications tend to have higher capital intensity ratios because they require substantial investment in physical assets to produce goods or provide services. Conversely, industries like software, consulting, and services may have lower capital intensity ratios as they rely more on human capital and less on physical assets.