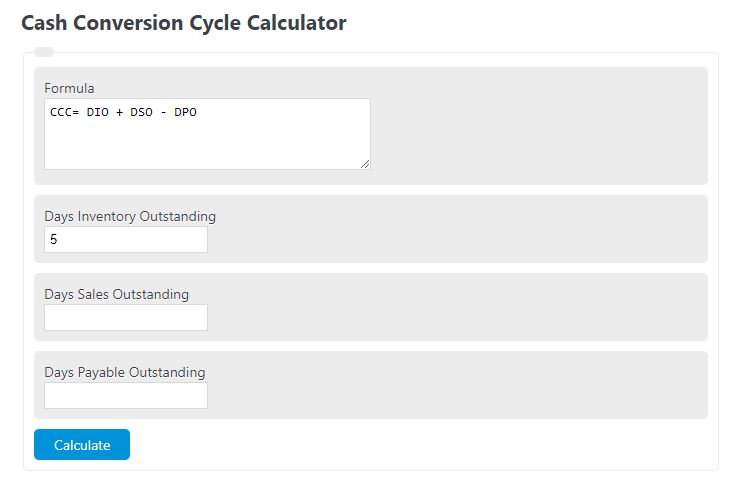

Enter the days of inventory outstanding, days of sales outstanding, and days payables outstanding to determine the cash conversion lifecycle.

Cash Conversion Cycle Formula

The following formula is used to calculate the cash conversion lifecycle.

CCC= DIO + DSO - DPO

- Where CC is the cash conversion time

- DIO is the days of inventory outstanding

- DSO is the days sales outstanding

- DPO is the days payables outstanding

DIO is a financial metric that calculates the average number of days it takes for a company to turn its inventory into sales.

DSO measures the average number of days it takes for a company to collect payment from its customers after a sale has been made.

DPO measures the average number of days it takes for a company to pay its outstanding invoices to suppliers or vendors.

What is a Cash Conversion Cycle?

The cash conversion cycle (CCC) is a financial metric that measures the time it takes for a company to convert its investments in inventory and other resources into cash flow from sales. It is a crucial indicator of a company’s efficiency in managing its working capital. The CCC is calculated by adding the number of days it takes for a company to sell its inventory, the number of days it takes to collect cash from customers after a sale, and subtracting the number of days it takes to pay suppliers for inventory purchases.

A shorter cash conversion cycle is generally seen as favorable, implying that a company can quickly convert its investments into cash flow. This can lead to increased liquidity, improved profitability, and reduced financing costs. It also indicates that a company effectively manages its inventory levels, sales collection, and payment terms with suppliers. On the other hand, a longer cash conversion cycle can have negative implications, such as tying up cash in inventory or extended credit terms to customers, which may strain a company’s cash flow and overall financial health.

Cash Conversion Cycle Example

How to calculate cash conversion cycle?

- First, determine the days of inventory outstanding.

This is the average number of days a produced good stays in inventory on average before being sold.

- Next, determine the days sales outstanding.

This is the average number of days it takes a company to collect on previously sold goods or services.

- Next, determine the days payable outstanding.

This is the number of days it takes the company to pay its own obligations associated with the resources used to produce the good.

- Finally, calculate the cash conversion time.

Using the formula you can calculate the cash conversion cycle.

FAQ

How does the Days Inventory Outstanding (DIO) affect a company’s cash conversion cycle?

DIO directly impacts the cash conversion cycle by determining how long a company’s goods remain in inventory before being sold. A lower DIO indicates that a company is converting its inventory into sales more quickly, potentially shortening the cash conversion cycle and improving liquidity.

Why is a shorter cash conversion cycle considered favorable for businesses?

A shorter cash conversion cycle is seen as favorable because it means the company is more efficient at converting its investments in inventory into cash flows from sales. This efficiency leads to increased liquidity, reduced financing costs, and potentially higher profitability, indicating effective management of working capital.

Can a company’s payment terms with suppliers affect its Days Payables Outstanding (DPO)?

Yes, a company’s payment terms with its suppliers directly affect its DPO. Longer payment terms increase the DPO, allowing the company to hold onto its cash longer, which can positively affect the cash conversion cycle by providing more liquidity and flexibility in cash flow management.

What strategies can businesses employ to improve their cash conversion cycle?

Businesses can employ several strategies to improve their cash conversion cycle, including reducing the days of inventory outstanding by optimizing inventory levels, accelerating the collection of receivables to decrease days sales outstanding, and negotiating longer payment terms with suppliers to increase days payables outstanding. Each of these strategies can help a business convert its resources into cash more quickly and efficiently.