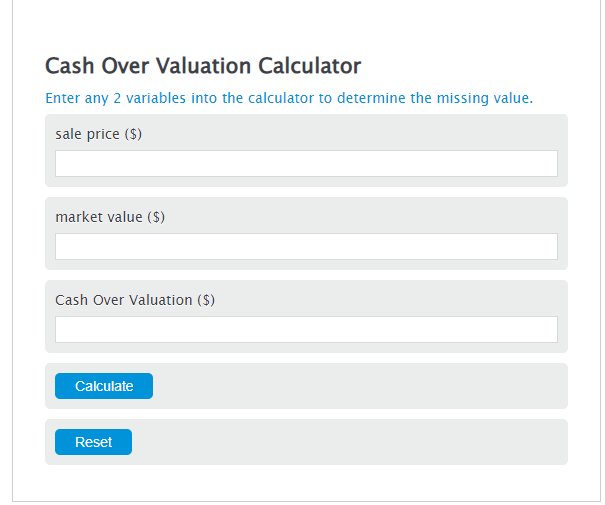

Enter the sale price ($) and the market value ($) into the Calculator. The calculator will evaluate the Cash Over Valuation.

- Sales To Market Value Ratio Calculator

- Company Valuation Based on Revenue Calculator

- Startup Valuation Calculator

Cash Over Valuation Formula

COV = SP - MV

Variables:

- COV is the Cash Over Valuation ($)

- SP is the sale price ($)

- MV is the market value ($)

To calculate Cash Over Valuation, subtract the current market value from the sales price of the asset.

How to Calculate Cash Over Valuation?

The following steps outline how to calculate the Cash Over Valuation.

- First, determine the sale price ($).

- Next, determine the market value ($).

- Next, gather the formula from above = COV = SP – MV.

- Finally, calculate the Cash Over Valuation.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

sale price ($) = 50000

market value ($) = 40000

Frequently Asked Questions

What is Cash Over Valuation (COV)?

Cash Over Valuation refers to the difference between the sale price of a property and its market value. If the sale price is higher than the market value, the difference is the COV.

Why is calculating Cash Over Valuation important?

Calculating COV is crucial for both buyers and sellers to understand the actual value of a property compared to its selling price. It helps in making informed decisions during property transactions.

Can COV be negative, and what does it imply?

Yes, COV can be negative if the market value of a property is higher than its sale price. This implies that the buyer is purchasing the property below its market value, potentially getting a good deal.

How does market value affect COV?

The market value of a property plays a critical role in determining COV. A higher market value compared to the sale price results in a lower COV, indicating a potentially better purchase price for the buyer.