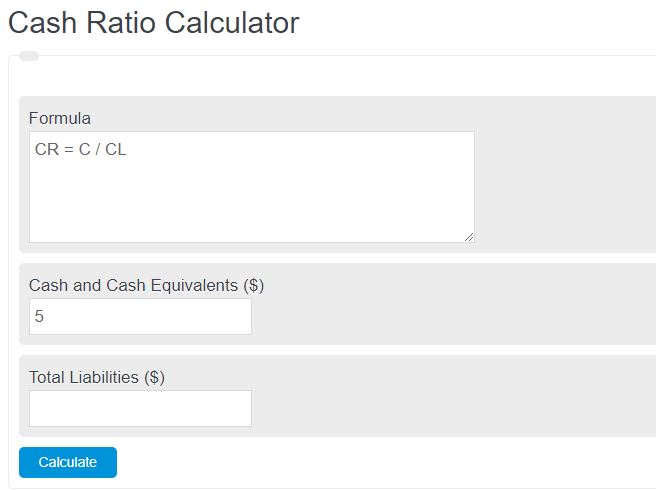

Enter the total cash and cash equivalents, along with the current liabilities, into the calculator. The calculator will evaluate and display the cash ratio of the business.

Cash Ratio Formula

The following formula can be used to calculate the cash ratio of a business.

CR = C / CL

- Where CR is the cash ratio

- C is the cash and cash equivalents

- CL is the current liabilities.

Cash and cash equivalents refer to highly liquid assets that can be readily converted into cash, typically including cash on hand, bank deposits, and short-term investments with a maturity date of three months or less.

Current liabilities are debts or obligations a company must settle within one year or its operating cycle.

Cash Ratio Definition

The cash ratio is a metric that measures the proportion of a company’s liquid assets to its current liabilities. In simpler terms, it helps assess how well a company can cover its short-term obligations using only its cash and cash equivalents. It is a valuable indicator of a company’s ability to manage its immediate financial obligations without relying on other sources like borrowing or selling assets.

The cash ratio is an important metric for investors, lenders, and analysts as it indicates a company’s short-term solvency and liquidity. A higher cash ratio suggests a stronger ability to meet short-term obligations, which is generally viewed as favorable. However, an excessively high cash ratio may indicate that the company is not utilizing its resources effectively and could potentially invest the excess cash elsewhere to generate more returns.

While the cash ratio provides insights into a company’s financial health, it should not be considered in isolation but rather in conjunction with other financial ratios and factors. Nonetheless, understanding the cash ratio can help individuals gain a better grasp of a company’s ability to manage its immediate financial responsibilities.

Can the cash ratio be negative?

A cash ratio cannot be negative. Looking at the formula above, you can see that a cash ratio is a ratio of cash to liabilities. When a company is said to have a negative amount of cash, it’s considered a liability. So, if the company has no cash, but a lot of liabilities, then the ratio would be 0 but would never drop below 0 to be negative.

Is the cash ratio a percentage?

A cash ratio, by definition, is simply a ratio of cash to liabilities. This ratio can be converted to a percentage by multiplying the ratio by 100, but the initial ratio, when calculated, is not a percentage.

What can cash ratios tell you about a company?

A cash ratio’s main purpose is to describe how well-positioned a company is to cover its debts and liabilities. It’s a more conservative or simple way to look at liquidity than a typical liquidity ratio.

A cash ratio is more conservative than current ratios or quick ratios because it excludes the value of the other assets of the company. The numerator only includes cash and cash equivalents.

A cash ratio of less than 1 means the company has more liabilities than current cash. This is typical, especially in early-stage companies. A cash ratio of greater than 1 means the company has more cash than liabilities and could pay off all of those liabilities immediately. This is more common for companies that have been in business for a long time.

What is a good cash ratio?

A good cash ratio entirely depends on the company being analyzed. For example, you would expect an early startup to have a cash ratio of less than one since it should be seeking loans to grow its business. In more general terms though, the higher the cash ratio the better positioned the company is to deal with downturns in business.

Cash Ratio Example

How to calculate a cash ratio?

- First, determine the total cash.

Calculate the total cash and cash equivalents of a business.

- Next, determine the current liabilities.

Calculate the current liabilities owned by the company.

- Finally, calculate the cash ratio.

Using the formula above, calculate the cash ratio.

FAQ

A cash ratio is the ratio of cash and cash equivalents to the total cost of liabilities that a company owns. This ratio is used to measure liquidity in a company.