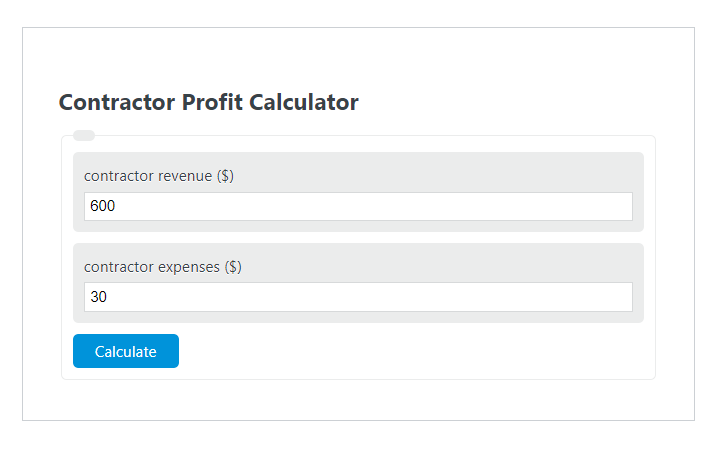

Enter the contractor revenue ($) and the contractor expenses ($) into the calculator to determine the Contractor Profit.

Contractor Profit Formula

The following formula is used to calculate the Contractor Profit.

CP = CR - CE

- Where CP is the Contractor Profit ($)

- CR is the contractor revenue ($)

- CE is the contractor expenses ($)

How to Calculate Contractor Profit?

The following example problems outline how to calculate Contractor Profit.

Example Problem #1:

- First, determine the contractor revenue ($). In this example, the contractor revenue ($) is given as 143.

- Next, determine the contractor expenses ($). For this problem, the contractor expenses ($) is given as 20.

- Finally, calculate the Contractor Profit using the equation above:

CP = CR – CE

The values given above are inserted into the equation below:

CP = 143 – 20 = 123 ($)

FAQ

What factors can affect contractor expenses?

Several factors can affect contractor expenses including labor costs, material costs, equipment rental or purchase, insurance, and permits or licensing fees. Market fluctuations and the specific demands of a project (such as specialized labor or materials) can also significantly impact expenses.

How can a contractor increase their profit margin?

Contractors can increase their profit margin by optimizing operational efficiency, reducing waste, negotiating better prices for materials, improving project management, and enhancing the quality of work to secure higher-paying projects. Additionally, expanding services and adopting new technologies for efficiency can also contribute to higher profits.

Is it important for contractors to track both revenue and expenses closely?

Yes, it’s crucial for contractors to track both revenue and expenses closely. This enables them to understand their financial health, identify areas for cost reduction, forecast future profitability, and make informed business decisions. Accurate financial tracking also aids in tax preparation and compliance with regulations.