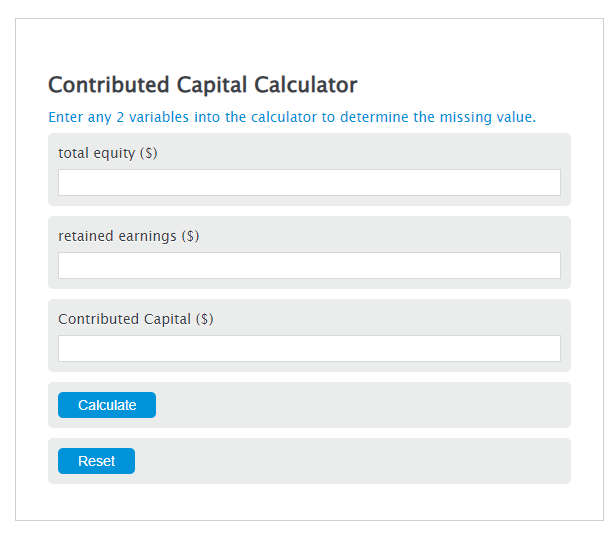

Enter the total equity ($) and the retained earnings ($) into the Calculator. The calculator will evaluate the Contributed Capital.

- Capital Charge Factor Calculator

- Capital Intensity Ratio Calculator

- Debt to Capital Ratio Calculator

Contributed Capital Formula

CC = TE - RE

Variables:

- CC is the Contributed Capital ($)

- TE is the total equity ($)

- RE is the retained earnings ($)

To calculate Contributed Capital, subtract the retained earning from the total equity.

How to Calculate Contributed Capital?

The following steps outline how to calculate the Contributed Capital.

- First, determine the total equity ($).

- Next, determine the retained earnings ($).

- Next, gather the formula from above = CC = TE – RE.

- Finally, calculate the Contributed Capital.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

total equity ($) = 79

retained earnings ($) = 23

FAQs

What is Contributed Capital?

Contributed Capital, also known as paid-in capital, represents the funds raised by a company through the issuance of shares to investors. It is part of a company’s total equity and is calculated by subtracting retained earnings from total equity.

Why is Contributed Capital important?

Contributed Capital is important because it reflects the amount of money that shareholders have directly invested in the company. This figure is crucial for investors as it helps them understand the equity structure of the company and the value of their investment.

How does Retained Earnings affect Contributed Capital?

Retained Earnings represent the portion of net income that is not distributed to shareholders as dividends but is instead retained by the company for reinvestment. Since Contributed Capital is calculated by subtracting Retained Earnings from Total Equity, an increase in Retained Earnings will result in a decrease in Contributed Capital, and vice versa.

Can Contributed Capital change over time?

Yes, Contributed Capital can change over time. It can increase when a company issues new shares of stock and raises more equity from investors. Conversely, it can decrease if the company buys back its shares, reducing the amount of equity held by shareholders.