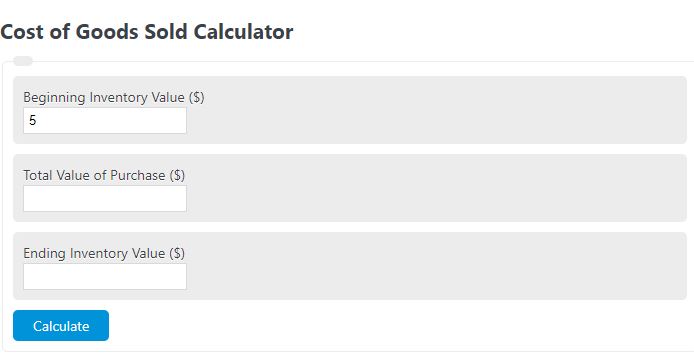

Enter the value of the beginning inventory, the total value of purchases, and the ending inventory value into the calculator to determine the cost of goods sold.

- Cost of Goods Manufactured Calculator (COGM)

- Ending Inventory Calculator

- Fixed Cost Calculator

- Cost of Sales Calculator

- Inventory Turnover Ratio Calculator

- Cost of Goods Purchased Calculator

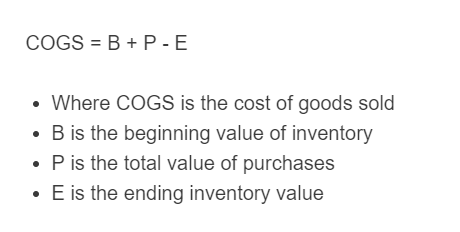

Cost of Goods Sold Formula

The following equation is used to calculate the total cost of goods sold.

COGS = B + P - E

- Where COGS is the cost of goods sold

- B is the beginning value of the inventory

- P is the total value of purchases

- E is the ending inventory value

To calculate the cost of goods sold (COGS), sum the beginning value of the inventory and the total value of purchases, then subtract the ending inventory value.

COGS Definition

COGS, or Cost of Goods Sold, represents the direct expenses a company incurs in producing or acquiring the goods it sells.

It encompasses the costs directly related to the production or purchase of inventory items, including materials, labor, and overhead costs. COGS is a critical metric for businesses as it directly impacts their profitability and financial health.

COGS reflects the actual cost of creating or acquiring products sold to customers. By deducting COGS from the total revenue, companies can determine their gross profit, athe amount remaining after accounting for the direct production costs.

Cost of Goods Sold Example

How to calculate cost of goods sold

- Fist, determine the beginning inventory value

Calculate the total value of your inventory before any goods are sold.

- Next, determine the total value of purchases made

Calculate the total value of the items sold during the time period being analyzed.

- Next, determine the ending inventory value

Calculate the value of your inventory after items have been sold.

- Finally, calculate the COGS

Calculate the cost of goods sold using the formula above and information from steps 1-3.

FAQ

How does COGS affect a company’s financial statements?

COGS directly impacts the gross profit reported on a company’s income statement. A higher COGS will result in a lower gross profit, affecting the net income negatively.

Can COGS influence pricing strategies?

Yes, understanding COGS helps businesses set competitive pricing strategies. By knowing the direct costs associated with their products, companies can price their goods to cover costs and ensure a profit margin.

Why is accurate calculation of COGS important?

Accurate calculation of COGS is crucial for financial reporting, inventory management, and assessing a company’s profitability. It aids in making informed decisions regarding pricing, cost control, and financial planning.

How can businesses reduce their COGS?

Businesses can reduce their COGS by negotiating better prices for raw materials, improving production efficiency, reducing waste, or finding more cost-effective suppliers.