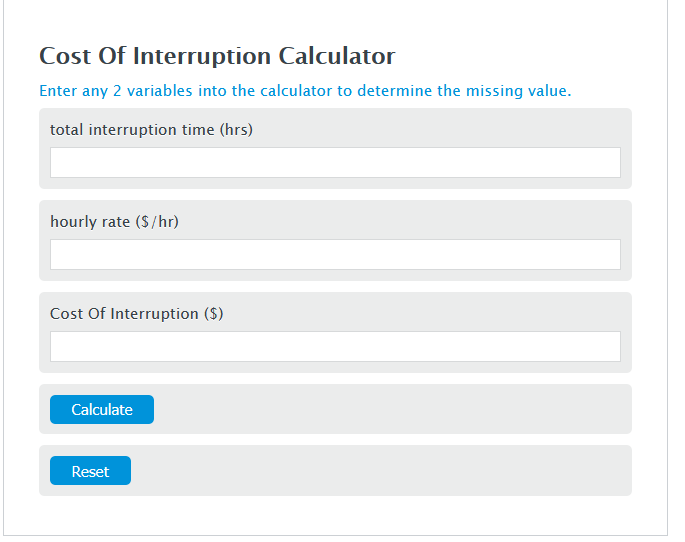

Enter the total interruption time (hrs) and the hourly rate ($/hr) into the Calculator. The calculator will evaluate the Cost Of Interruption.

Cost Of Interruption Formula

COI = IT * HR

Variables:

- COI is the Cost Of Interruption ($)

- IT is the total interruption time (hrs)

- HR is the hourly rate ($/hr)

To calculate the Cost Of Interruption, multiply the total interruption time by the combined hourly rate.

How to Calculate Cost Of Interruption?

The following steps outline how to calculate the Cost Of Interruption.

- First, determine the total interruption time (hrs).

- Next, determine the hourly rate ($/hr).

- Next, gather the formula from above = COI = IT * HR.

- Finally, calculate the Cost Of Interruption.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

total interruption time (hrs) = 2

hourly rate ($/hr) = 50

FAQ

What factors can affect the Cost Of Interruption?

Several factors can affect the Cost Of Interruption, including the duration of the interruption, the hourly rate of the employees or processes affected, the time of day or week the interruption occurs (peak vs. off-peak hours), and the efficiency of the process for resuming normal operations.

How can businesses minimize the Cost Of Interruption?

Businesses can minimize the Cost Of Interruption by implementing robust risk management strategies, maintaining backup systems, training employees for quick recovery, scheduling maintenance during off-peak hours, and improving process efficiency to reduce downtime.

Are there any industries particularly vulnerable to high Costs Of Interruption?

Yes, industries that rely heavily on continuous production processes, such as manufacturing, utilities, and IT services, are particularly vulnerable to high Costs Of Interruption due to the significant impact of downtime on their operations and revenue.

Can the Cost Of Interruption be insured against?

Yes, many businesses opt for business interruption insurance, which can cover lost income and additional expenses incurred as a result of an interruption to their operations. The specifics of coverage can vary widely depending on the policy and the insurer.