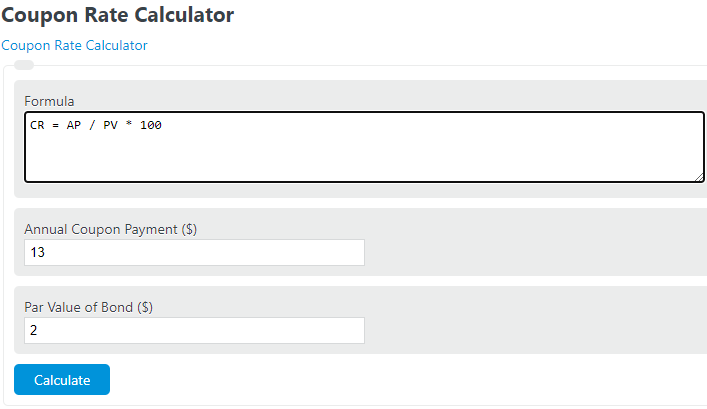

Enter the total annual coupon payment, and the par value of the bond into the calculator to determine the coupon rate. This calculator can also evaluate the annual payment or par value if the other variables are known.

- Zero Coupon Bond Calculator

- Bond Equivalent Yield Calculator (+ Formula)

- Modified Duration Calculator

- Maturity Value Calculator

- Constant/Conditional Prepayment Rate (CPR) Calculator

Coupon Rate Formula

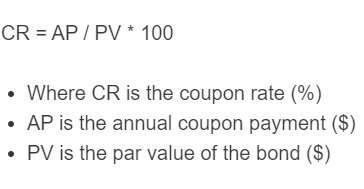

The following is the coupon rate formula:

CR = AP / PV * 100

- Where CR is the coupon rate (%)

- AP is the annual coupon payment ($)

- PV is the par value of the bond ($)

To calculate a coupon rate, divide the annual coupon payment by the par value of the bond, then multiply by 100.

Coupon Rate Definition

A coupon rate is defined as the rate of interest paid to the bondholders by the bond issuers of any given bond.

Can a coupon rate change?

A coupon rate can change if the bond or security is variable rate security. The most common type of bond is a fixed rate bond, which would not have its coupon rate changed.

What affects coupon rate?

The formula above shows that only the annual coupon payment and the par value of the bond affect the coupon rate. Those two variables, however, can be influenced by other factors at the time of purchase.

Is coupon rate and yield to maturity the same?

A coupon rate and yield to maturity can be the same if the bond is purchased at face value, but not if the bond is purchased at more or less than the face value.

Why is the coupon rate higher than the yield?

A coupon rate can be higher than a yield when an investor purchases a bond at a premium over its face value. A coupon rate can be lower than a yield when the bond is purchased at a lower price than face value.

How to calculate coupon rate?

- First, determine the face value of the bond. Calculate or determine the market price of the face value of the bond.

- Next, determine the annual coupon payment received.

- Finally, calculate the annual coupon rate using the formula shown above.