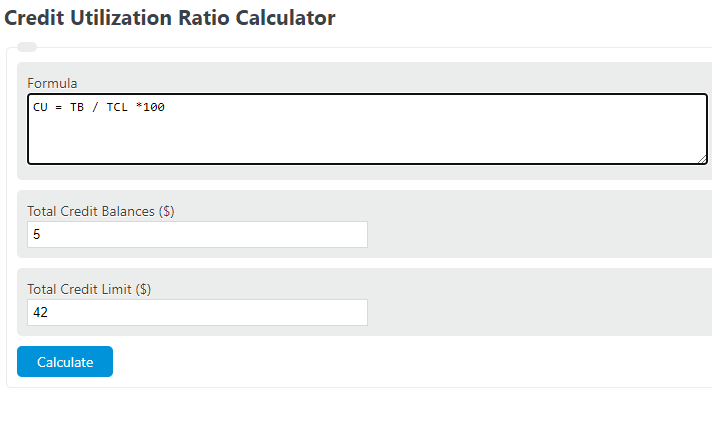

Enter the total amount of open credit balances and the total credit limit on all lines of credit to determine the credit utilization ratio.

Credit Utilization Ratio Formula

The following formula is used to calculate a credit utilization ratio.

CU = TB / TCL *100

- Where CU is the credit utilization ratio (%)

- TB is the total credit balance ($)

- TCL is the total credit limit ($)

To calculate the credit utilization ratio, divide the credit balance by the credit limit, then multiply by 100.

Credit Utilization Ratio Definition

A credit utilization ratio measures the total percentage or proportion of the total available credit limit that a person uses at any given time.

Credit Utilization Ratio Example

How to calculate a credit utilization ratio?

- First, determine the total credit balances.

Add together all of the balances on open credit cards/ credit lines.

- Next, determine the total available credit.

Add together all of the credit limits together to find the total.

- Finally, calculate the credit utilization.

Calculate the credit utilization using the formula above.

FAQ

Why is a low credit utilization ratio important?

A low credit utilization ratio is important because it indicates to lenders that you’re not overly reliant on credit and are managing your credit well. It can positively affect your credit score, making it easier to obtain loans with favorable terms in the future.

How can I improve my credit utilization ratio?

To improve your credit utilization ratio, you can pay down existing balances, avoid accumulating more debt, and request higher credit limits from your creditors. Keeping your credit balances low relative to your total credit limits will lower your utilization ratio.

Does paying off my credit card in full each month affect my credit utilization ratio?

Yes, paying off your credit card in full each month can positively affect your credit utilization ratio because it lowers your total outstanding balance relative to your credit limit. This can lead to an improvement in your credit score over time.