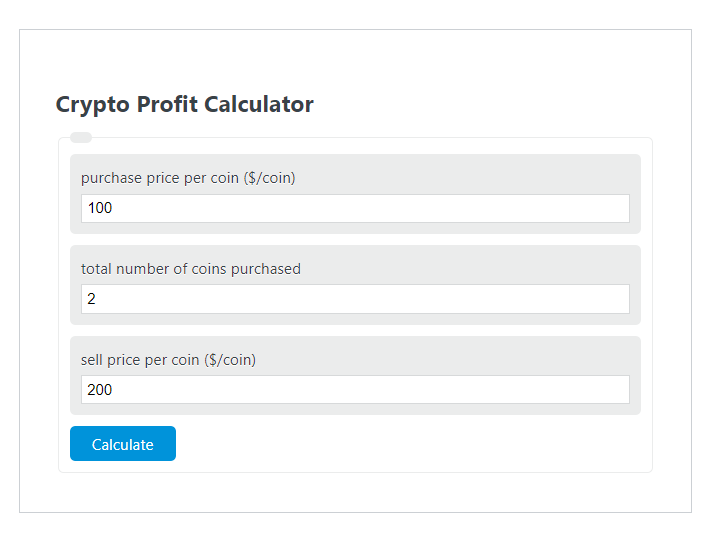

Enter the purchase price per coin ($/coin), the total number of coins purchased, and the selling price per coin ($/coin) into the calculator to determine the Crypto Profit.

- All Profit Calculators

- Dogecoin Profit Calculator

- Stock Calculator (Profit Calculator)

- Lost Profits Calculator

Crypto Profit Formula

The following formula is used to calculate the Crypto Profit.

Pc = (SP - PP) * C

- Where Pc is the Crypto Profit ($)

- PP is the purchase price per coin ($/coin)

- #C is the total number of coins purchased

- SP is the selling price per coin ($/coin)

To calculate the crypto profit, subtract the purchase price from the selling price, then multiply by the number of coins.

How to Calculate Crypto Profit?

The following example problems outline how to calculate Crypto Profit.

Example Problem #1

- First, determine the purchase price per coin ($/coin). In this example, the purchase price per coin ($/coin) is given as 100 .

- Next, determine the total number of coins purchased. For this problem, the total number of coins purchased is given as 3.25 .

- Next, determine the sell price per coin ($/coin). In this case, the sell price per coin ($/coin) is found to be 150.

- Finally, calculate the Crypto Profit using the formula above:

Pc = (SP – PP) * #C

Inserting the values from above yields:

Pc = (150 – 100) *3.25 = 162.5 ($)

FAQ

What factors can affect the profitability of cryptocurrency investments?

The profitability of cryptocurrency investments can be influenced by various factors including market volatility, transaction fees, the timing of the purchase and sale, regulatory changes, and the overall performance of the cryptocurrency market.

How can investors minimize risks when investing in cryptocurrencies?

Investors can minimize risks by diversifying their investment portfolio, staying informed about market trends and regulatory changes, using stop-loss orders to limit potential losses, and only investing money they can afford to lose.

Are there any tax implications for making a profit from cryptocurrency transactions?

Yes, many countries consider profits from cryptocurrency transactions as taxable income. It’s important for investors to keep detailed records of their transactions, including purchase and sale prices, dates, and amounts. Tax regulations vary by country, so consulting with a tax professional is recommended.