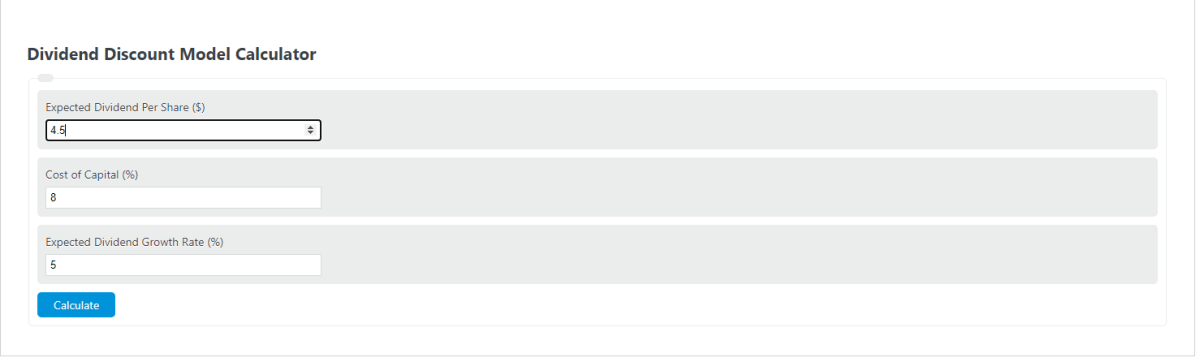

Enter the expected dividends per share, the cost of capital equity, and the dividend growth rate to determine the value of the stock using DDM.

- Dividend Yield Ratio Calculator

- Dividends Per Share Calculator

- Dividends Per Share Calculator

- Dividend Payout Ratio Calculator

DDM Formula

The following formula is used to calculate the value of a stock using DDM.

DDM = EDPS / (CCE - DGR)

- Where DDM is the stock value ($)

- EDPS is the expected dividend per share ($)

- CCE is the cost of capital equity (%)

- DGR is the dividend growth rate (%)

What is DDM (Dividend Discount Model)?

The Dividend Discount Model (DDM) is a financial valuation tool used to estimate the intrinsic value of a stock based on its future dividend payments. It operates under the assumption that the present value of a stock is the sum of all its future dividends, discounted to its present value using a required rate of return.

The DDM is important because it provides investors with a practical framework for determining the fair value of a stock.

By analyzing the future stream of dividends, investors can assess whether a stock is overvalued or undervalued. This information is crucial for making informed investment decisions.

The DDM's simplicity and intuitive nature make it a widely used model. It requires only two inputs: the expected future dividends and the required rate of return.

These inputs can be obtained from publicly available information, such as financial statements and market data. Consequently, the DDM can be applied to a wide range of stocks, making it a versatile tool for investors.

The DDM's focus on dividends is significant because they represent a tangible return on investment. Dividends are the portion of a company's earnings distributed to shareholders, providing a direct cash flow to investors.

By valuing a stock based on these cash flows, the DDM emphasizes the importance of dividends as a source of shareholder value.

Example Problem

How to calculate the stock value using DDM?

- First, determine the expected dividend per share for the current period.

For this example, the dividend per share is expected to be $4.50.

- Next, determine the cost of capital.

In this case, the cost of capital is found to be 8%.

- Next, determine the expected dividend growth rate.

This dividend is expected to grow at 5% per year.

- Finally, calculate the value of the stock using the discount dividend model.

Using the formula above, the stock value is found to be:

DDM = EDPS / (CCE - DGR)

DDM = 4.50 / (.08 - .05)

DDM = $150.00

FAQ

What is the significance of the cost of capital equity (CCE) in the DDM formula?

The cost of capital equity (CCE) is significant in the DDM formula as it represents the expected rate of return required by investors. It is used to discount future dividend payments to their present value, reflecting the opportunity cost of investing in the stock. A higher CCE indicates a higher expected return, which can lower the stock's present value according to DDM.

How can an investor determine the expected dividend per share?

An investor can determine the expected dividend per share by analyzing the company's historical dividend payments, its dividend policy, and its earnings forecasts. Many companies have a stable dividend policy, making their future dividends relatively predictable. Additionally, financial analysts often provide dividend forecasts based on their expectations of the company's future earnings and payout ratios.

Why is the dividend growth rate important in evaluating a stock using DDM?

The dividend growth rate is important because it reflects the expected rate at which a company's dividend payments will increase over time. In the DDM formula, a higher dividend growth rate increases the value of future dividends, leading to a higher present value of the stock. It indicates the company's growth prospects and its ability to increase shareholder value through rising dividend payments.

Can the DDM be applied to all stocks?

The DDM is most applicable to stocks of companies that pay dividends consistently and have a history of dividend growth. It is particularly useful for evaluating companies in stable and mature industries where dividends are a significant component of shareholder returns. However, it may not be suitable for companies that do not pay dividends, have highly unpredictable dividend payments, or are in rapidly changing industries where future dividends are difficult to estimate.