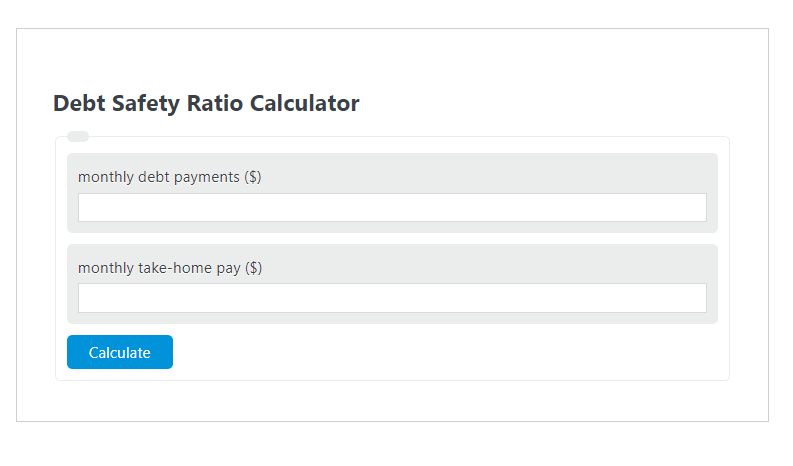

Enter the monthly debt payments ($) and the monthly take-home pay ($) into the Debt Safety Ratio Calculator. The calculator will evaluate and display the Debt Safety Ratio.

- All Ratio Calculators

- Debt to Capital Ratio Calculator

- Debt to GDP Ratio Calculator

- Debt to Asset Ratio Calculator

Debt Safety Ratio Formula

The following formula is used to calculate the Debt Safety Ratio.

DSR = MD / MTH *100

- Where DSR is the Debt Safety Ratio (%)

- MD is the monthly debt payments ($)

- MTH is the monthly take-home pay ($)

To calculate the debt safety ratio, divide the monthly debt payments by the monthly take-home pay.

How to Calculate Debt Safety Ratio?

The following example problems outline how to calculate Debt Safety Ratio.

Example Problem #1:

- First, determine the monthly debt payments ($).

- The monthly debt payments ($) is given as: 2,500.

- Next, determine the monthly take-home pay ($).

- The monthly take-home pay ($) is provided as: 5,000.

- Finally, calculate the Debt Safety Ratio using the equation above:

DSR = MD / MTH *100

The values given above are inserted into the equation below and the solution is calculated:

DSR = 2,500 / 5,000 *100 = 50.00 (%)

FAQ

What is a good Debt Safety Ratio?

A good Debt Safety Ratio is generally considered to be below 36%. This indicates that a smaller portion of your take-home pay is going towards debt payments, which is seen as more manageable and less risky by lenders.

Why is the Debt Safety Ratio important?

The Debt Safety Ratio is important because it helps individuals and lenders assess the level of financial risk associated with taking on new debt. A lower ratio means that an individual has more of their income available for savings, investments, and emergencies, making them a lower risk for lenders.

Can the Debt Safety Ratio affect my ability to get a loan?

Yes, the Debt Safety Ratio can significantly affect your ability to get a loan. Lenders use this ratio among other financial indicators to determine your creditworthiness. A high Debt Safety Ratio might indicate to lenders that you are over-leveraged, making it harder to secure a loan or to get favorable loan terms.