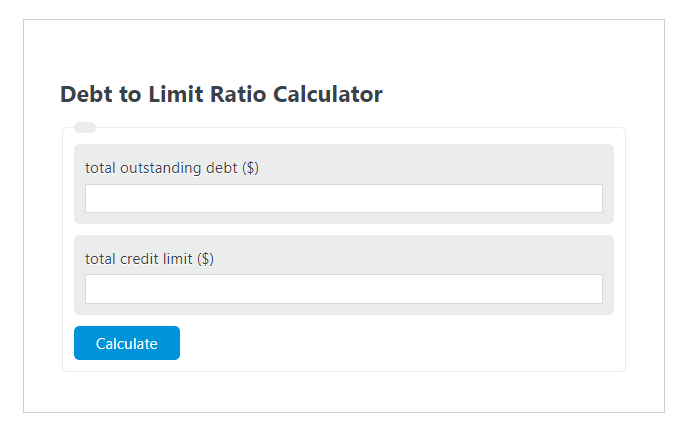

Enter the total outstanding debt ($) and the total credit limit ($) into the Debt to Limit Ratio Calculator. The calculator will evaluate and display the Debt to Limit Ratio.

- All Ratio Calculators

- Long-Term Debt Ratio Calculator

- Debt Safety Ratio Calculator

- Credit Utilization Ratio Calculator

Debt to Limit Ratio Formula

The following formula is used to calculate the Debt to Limit Ratio.

DLIR = OD / CL * 100

- Where DLIR is the Debt to Limit Ratio (%)

- OD is the total outstanding debt ($)

- CL is the total credit limit ($)

To calculate the debt-to-limit ratio, divide the outstanding debt by the total credit limit.

How to Calculate Debt to Limit Ratio?

The following example problems outline how to calculate Debt to Limit Ratio.

Example Problem #1:

- First, determine the total outstanding debt ($).

- The total outstanding debt ($) is given as: 3,000.

- Next, determine the total credit limit ($).

- The total credit limit ($) is provided as: 9,000.

- Finally, calculate the Debt to Limit Ratio using the equation above:

DLIR = OD / CL * 100

The values given above are inserted into the equation below and the solution is calculated:

DLIR = 3,000 / 9,000 * 100 = 33.33 (%)

FAQ

What is the significance of calculating the Debt to Limit Ratio?

The Debt to Limit Ratio is a crucial financial metric that lenders and credit bureaus use to assess an individual’s creditworthiness. A lower ratio indicates better financial health, as it suggests that an individual is using a smaller portion of their available credit, which can lead to higher credit scores and better loan terms.

How can one improve their Debt to Limit Ratio?

Improving the Debt to Limit Ratio can be achieved by either reducing the total outstanding debt or increasing the total credit limit. Paying down credit card balances, consolidating debts, or requesting higher credit limits from lenders can help lower the ratio. It’s also important to avoid opening new credit accounts unless necessary, as this can temporarily lower your credit score.

Does the Debt to Limit Ratio affect all types of credit scores?

Yes, the Debt to Limit Ratio, also known as the credit utilization ratio, affects all types of credit scores. It is a key component of the amounts owed category, which can account for up to 30% of a FICO score. Lenders and credit scoring models view this ratio as a significant indicator of borrowing behavior and financial stability.