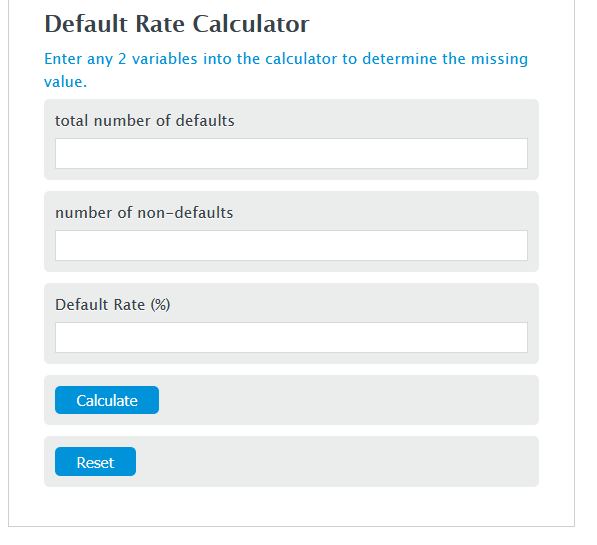

Enter the total number of defaults and the number of non-defaults into the Calculator. The calculator will evaluate the Default Rate.

Default Rate Formula

DFR = DF / NDF * 100

Variables:

- DFR is the Default Rate (%)

- DF is the total number of defaults

- NDF is the number of non-defaults

To calculate the Default Rate, divide the number of defaults by the number of non-defaults, then multiply by 100.

How to Calculate Default Rate?

The following steps outline how to calculate the Default Rate.

- First, determine the total number of defaults.

- Next, determine the number of non-defaults.

- Next, gather the formula from above = DFR = DF / NDF * 100.

- Finally, calculate the Default Rate.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

total number of defaults = 94

number of non-defaults = 500

Frequently Asked Questions (FAQ)

What is a Default Rate?

A Default Rate refers to the percentage of defaults out of the total number of cases, indicating the frequency at which defaults occur within a dataset or financial context.

Why is calculating the Default Rate important?

Calculating the Default Rate is crucial for assessing the risk associated with lending, investments, and other financial activities. It helps in understanding the likelihood of default, which is vital for risk management and decision-making processes.

Can the Default Rate formula be used for any type of default analysis?

Yes, the Default Rate formula (DFR = DF / NDF * 100) is versatile and can be applied to various contexts where understanding the rate of default is necessary, such as credit risk assessment, loan defaults, and quality control processes.

How can the Default Rate impact financial decisions?

A higher Default Rate indicates a greater risk of default, which can influence lenders to impose higher interest rates, require more stringent borrowing conditions, or decide against lending altogether. For investors, it can signal the need to reassess the risk profile of their investments.