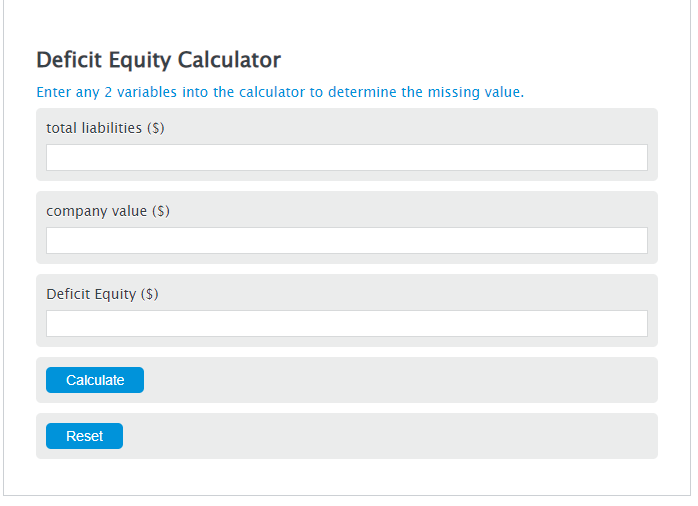

Enter the total liabilities ($) and the company value ($) into the Calculator. The calculator will evaluate the Deficit Equity.

Deficit Equity Formula

DE = L - V

Variables:

- DE is the Deficit Equity ($)

- L is the total liabilities ($)

- V is the company value ($)

To calculate Deficit Equity, subtract the company value from the total liabilities.

How to Calculate Deficit Equity?

The following steps outline how to calculate the Deficit Equity.

- First, determine the total liabilities ($).

- Next, determine the company value ($).

- Next, gather the formula from above = DE = L – V.

- Finally, calculate the Deficit Equity.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

total liabilities ($) = 500000

company value ($) = 2300000

FAQs about Deficit Equity

What is Deficit Equity?

Deficit Equity occurs when a company’s total liabilities exceed its total value, indicating a negative equity position. It is calculated by subtracting the company value from its total liabilities.

Why is Deficit Equity significant for a company?

Deficit Equity is a critical financial metric that indicates a company’s financial health. It can signal potential financial distress or insolvency, affecting the company’s ability to attract investment or secure loans.

Can a company recover from Deficit Equity?

Yes, a company can recover from Deficit Equity through various strategies, such as increasing revenue, reducing expenses, restructuring debt, or raising new equity capital. However, the recovery process can be challenging and requires careful financial management.

How often should a company calculate its Deficit Equity?

Companies should regularly monitor their Deficit Equity as part of their financial analysis, typically on a quarterly or annual basis. This helps in identifying any potential financial issues early and allows for timely corrective actions.