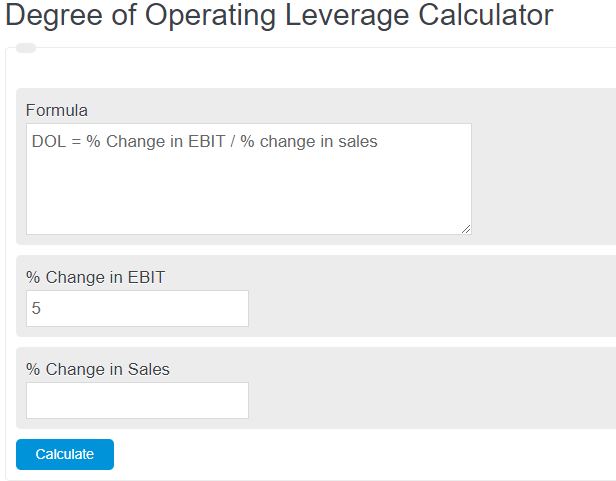

Enter the percentage change in the EBIT and the percentage change in sales into the calculator. The calculator will evaluate and display the degree of operating leverage.

- EBITDA Calculator

- Free Cash Flow Calculator

- Return on Employed Capital Calculator

- Financial Leverage Calculator

Degree of Operating Leverage Formula

The following equation is used to calculate the degree of operating leverage.

DOL = Change in EBIT / change in sales

DOL = % Change in EBIT / % change in sales

- Where DOL is the degree of operating leverage

- EBIT is the earnings before tax and income

To calculate the degree of operating leverage, divide the percentage change in EBIT by the percentage change in sales.

Degree of Operating Leverage Definition

Degree of Operating Leverage (DOL) is a financial metric used to assess the sensitivity of a company’s operating income to changes in its sales revenue. It quantifies the relationship between a company’s fixed and variable costs.

The DOL is crucial for businesses as it helps determine the impact of changes in sales on a company’s profitability. By understanding the degree of leverage, companies can make informed decisions regarding pricing strategies, cost control measures, and expansion plans.

A higher DOL indicates that a company has a higher proportion of fixed costs compared to variable costs. This means that a small change in sales revenue will have a significant impact on operating income. In such cases, even a slight increase in sales can lead to a much larger increase in profitability. On the other hand, a decrease in sales can have a more substantial negative effect on profitability.

A lower DOL implies that a company has a larger proportion of variable costs than fixed costs. In this scenario, changes in sales revenue have a lesser impact on operating income. Companies with a lower DOL are generally more resilient to fluctuations in sales volume but may have a lower profit potential during periods of growth.

Degree of Operating Leverage Example

How to calculate the degree of operating leverage?

- First, determine the change in EBIT.

Calculate the change in EBIT over some time period.

- Next, determine the change in sales.

Over the same time period, calculate the change in sales.

- Finally, calculate the degree of operating leverage.

Calculate the degree of operating leverage using the formula above.

FAQ

What is EBIT and how is it relevant to operating leverage?

EBIT stands for Earnings Before Interest and Taxes. It is a measure of a company’s profitability that excludes interest and income tax expenses. EBIT is relevant to operating leverage because it focuses on the operational performance of a company, ignoring financial structure and tax environments, thus providing a clearer view of the company’s operational efficiency and its ability to generate profits from operations.

How does a high degree of operating leverage affect a company’s financial risk?

A high degree of operating leverage indicates that a company has a higher proportion of fixed costs in its cost structure. While this can lead to higher profits with increasing sales, it also increases the company’s financial risk. If sales decline, the company still incurs these fixed costs, which can significantly impact profitability and lead to losses. Therefore, a high degree of operating leverage amplifies the risk of financial distress during periods of low sales.

Can the degree of operating leverage change over time?

Yes, the degree of operating leverage can change over time as a company’s cost structure changes. If a company invests more in fixed assets or enters into long-term fixed cost agreements, its fixed costs will increase, potentially increasing its degree of operating leverage. Conversely, if a company shifts towards a more variable cost structure, its degree of operating leverage may decrease. Changes in business operations, strategy, and market conditions can all influence a company’s degree of operating leverage.