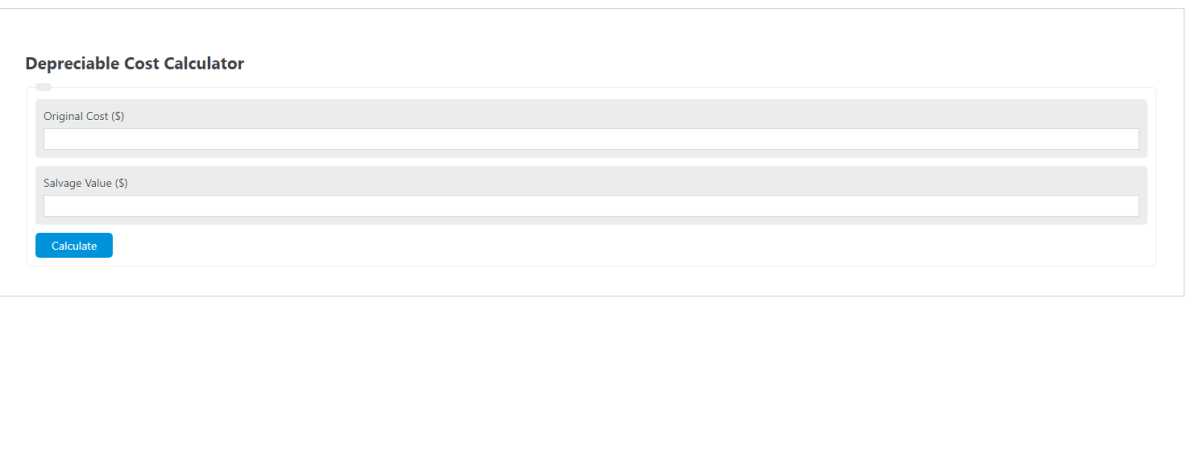

Enter the total cost and the salvage value into the calculator to determine the depreciable cost.

- Salvage Value Calculator

- Residual Value Calculator

- Furniture Depreciation Calculator

- Appliance Depreciation Calculator

Depreciable Cost Formula

The following formula is used to calculate a depreciable cost:

DC = TC - SV

- Where DC is the depreciable cost

- TC is the total original cost

- SV is the salvage value

To calculate the depreciable cost, subtract the salvage value from the total original cost.

Depreciable Cost Definition

What is a depreciable cost?

A depreciable cost measures the total cost or price that an item or asset has lost due to depreciation. This depreciable cost is important for determining depreciation %, as well as tax write-offs for the loss in value.

Example Problem

How to calculate a depreciable cost?

The following example problem outlines the steps needed to calculate a depreciated cost of an asset. In this case, the asset will be a car, which is one of the most commonly owned depreciating assets.

First, determine the original cost. In this case, the original cost is found to be $20,000.00.

Next, determine the salvage value. This is the amount of value a person could get for the asset currently. For this example, the salvage value is $12,000.00.

Finally, calculate the depreciable cost using the formula above:

DC = TC – SV

DC = $20,000 – $12,000

DC = $8,000.00

FAQ

What factors affect the salvage value of an asset?

Several factors can affect the salvage value of an asset, including its initial cost, age, wear and tear, technological obsolescence, and market demand for the asset. The method of depreciation used can also influence the salvage value.

Can depreciable cost change over the life of an asset?

Yes, the depreciable cost can change if there are adjustments to the asset’s salvage value or useful life. For instance, if an asset is expected to last longer or shorter than initially estimated, or if its salvage value is revised due to market changes, the depreciable cost would need to be recalculated.

How does depreciation affect tax calculations?

Depreciation affects tax calculations by reducing the taxable income of a business. The depreciable cost of an asset is allocated over its useful life, and each year, a portion of this cost is deducted from the business’s income, thereby lowering the amount of income subject to taxes.