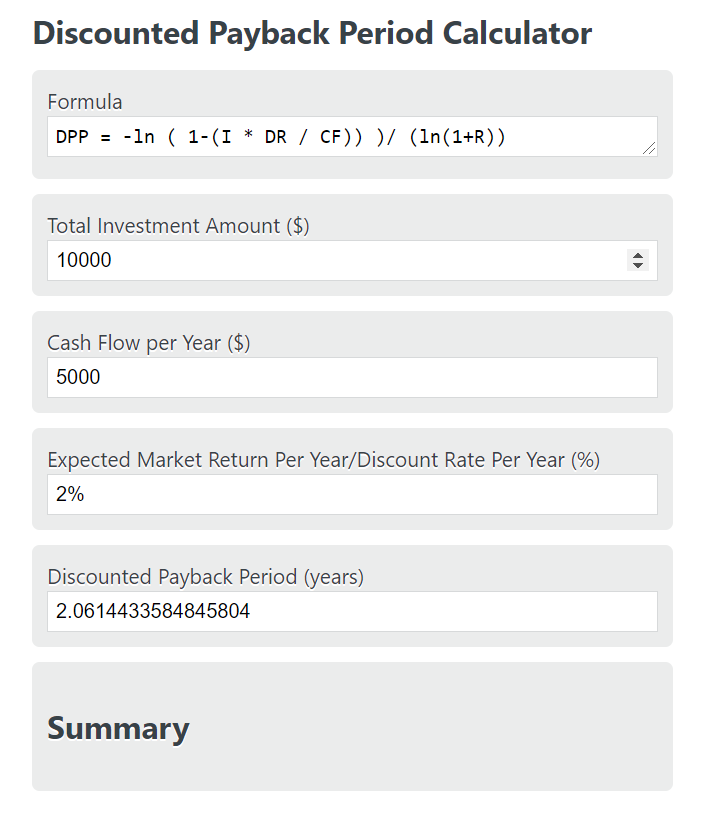

Enter the total investment amount, yearly cash flow, and average return or discounted rate into the calculator to determine the discounted payback period in years.

- ROI Calculator – Return on Investment

- Net Cash Flow Calculator

- Free Cash Flow Calculator

- Uneven Cash Flow Calculator

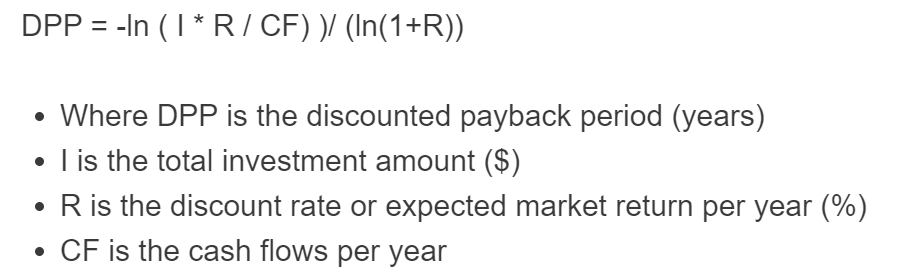

Discounted Payback Period Formula

The following formula is used to calculate a discounted payback period.

DPP = -ln ( I * R / CF) )/ (ln(1+R))

- Where DPP is the discounted payback period (years)

- I is the total investment amount ($)

- R is the discount rate or expected market return per year (%)

- CF is the cash flow per year

Discounted Payback Period Definition

Discounted Payback Period is a financial metric used to determine the time it takes for an investment to recoup its initial cost while considering the time value of money.

Unlike the traditional Payback Period, which ignores the concept of interest rates, Discounted Payback Period considers the present value of future cash flows by discounting them to their current value.

This metric is essential because it helps investors evaluate the profitability and risk associated with an investment project. By incorporating the time value of money, Discounted Payback Period provides a more accurate assessment of an investment's potential return.

It considers the opportunity cost of tying up capital in a project and allows investors to compare different investment options more effectively.

When is discounted payback period used?

A discounted payback period is used as one part of a capital budgeting analysis to determine which projects should be taken on by a company. A discounted payback period is used when a more accurate measurement of the return of a project is required. This discounted payback period is more accurate than a standard payback period because it takes into account the time value of money.

In short, the time value of money is a way of describing the potential return of money. So, the time you receive cash flow and the average expected return of the market are key factors in the discounted cash flow models.

What is the difference between the regular and discounted payback periods?

The main difference between the regular and discounted payback periods is that the discounted payback period takes into account the time value of money, and the regular payback period does not. This makes the discounted period more accurate but also more difficult to calculate.

For this reason, sometimes, the regular payback period is used early on as a simpler metric when determining what projects to take on. Then the discounted period is brought in for a more thorough analysis.

How to calculate a discounted payback period?

- First, determine the initial amount invested. For this example, we will assume $10,000.00 was invested in the project.

- Next, determine the cash flows from the project. For this example, we will say the yearly cash flows is $5,000.00.

- Next, determine the expected yearly return on cash flows. This is assumed to be 10%.

- Finally, calculate the discounted payback period. Using the formula we find the payback period to be 2.34 years.

FAQ

A discounted payback period is a type of payback period that uses discounted cash flows to calculate the time it takes an investment to pay back its initial cash flow.