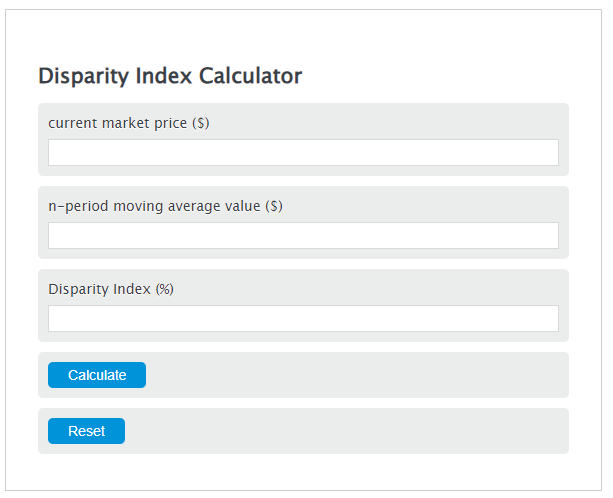

Enter the current market price ($) and the n-period moving average value ($) into the Calculator. The calculator will evaluate the Disparity Index.

- Sales To Market Value Ratio Calculator

- MVA (Market Value Added) Calculator

- Leverage Index Calculator

Disparity Index Formula

DI = (CMP - nPMAV) / nPMAV * 100

Variables:

- DI is the Disparity Index (%)

- CMP is the current market price ($)

- nPMAV is the n-period moving average value ($)

To calculate Disparity Index, divide the difference between the current market price and the n-period moving average value by the n-period moving average value, then multiply by 100.

How to Calculate Disparity Index?

The following steps outline how to calculate the Disparity Index.

- First, determine the current market price ($).

- Next, determine the n-period moving average value ($).

- Next, gather the formula from above = DI = (CMP – nPMAV) / nPMAV * 100.

- Finally, calculate the Disparity Index.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

current market price ($) = 45

n-period moving average value ($) = 37.5

FAQs

What is the significance of the Disparity Index in financial analysis?

The Disparity Index is a technical indicator that measures the relative position of an asset’s current price to its moving average. It is significant in financial analysis as it helps traders identify extreme price conditions, signaling potential buy or sell opportunities when the asset price diverges significantly from its moving average.

How can the Disparity Index help in market trend analysis?

The Disparity Index can be used to detect early signals of market trend reversals. A positive value indicates that the market price is moving above the average, suggesting bullish trends, while a negative value suggests bearish trends with prices moving below the average. This helps traders in making informed decisions on market entry and exit points.

Can the Disparity Index be used for all types of assets?

Yes, the Disparity Index can be applied to any asset with a price series, including stocks, bonds, commodities, and currencies. It is a versatile indicator that provides valuable insights regardless of the market or asset type, making it a useful tool for diverse trading strategies.

Is it necessary to use other indicators in conjunction with the Disparity Index?

While the Disparity Index can provide valuable market insights on its own, it is often beneficial to use it in conjunction with other technical indicators for a more comprehensive analysis. Combining it with indicators that measure volume, momentum, or volatility can help confirm signals and reduce the risk of false positives, leading to more robust trading strategies.