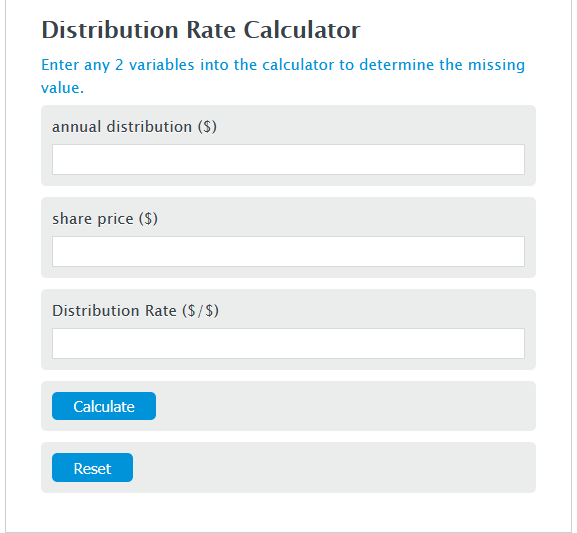

Enter the annual distributions ($) and the share price ($) into the Calculator. The calculator will evaluate the Distribution Rate.

Distribution Rate Formula

DISR = AD / SP

Variables:

- DISR is the Distribution Rate ($/$)

- AD is the annual distribution ($)

- SP is the share price ($)

To calculate the Distribution Rate, divide the annual distribution by the share price.

How to Calculate Distribution Rate?

The following steps outline how to calculate the Distribution Rate.

- First, determine the annual distributions ($).

- Next, determine the share price ($).

- Next, gather the formula from above = DISR = AD / SP.

- Finally, calculate the Distribution Rate.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

annual distributions ($) = 5000

share price ($) = 200

Frequently Asked Questions (FAQ)

What is a good distribution rate for investments?

A good distribution rate can vary greatly depending on the type of investment, market conditions, and investor objectives. Generally, a rate between 4% to 6% is considered healthy for most income-generating investments, but this can vary.

How does share price affect the distribution rate?

The share price directly affects the distribution rate as the rate is calculated by dividing the annual distribution by the share price. A higher share price would result in a lower distribution rate, all else being equal, and vice versa.

Can the distribution rate change over time?

Yes, the distribution rate can change over time due to variations in annual distributions and fluctuations in share price. Companies may increase or decrease distributions, and share prices can vary based on market conditions.

Is a higher distribution rate always better?

Not necessarily. While a higher distribution rate may seem attractive, it’s essential to consider the sustainability of distributions and the overall health of the investment. Extremely high rates might not be sustainable in the long term.