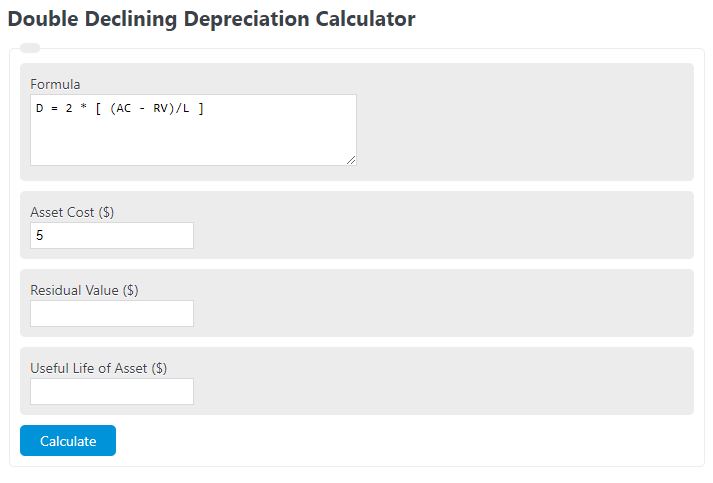

Enter the asset cost, residual value, and the useful life of the asset in years to determine the double-declining depreciation.

- Depreciation Tax Shield Calculator

- Units of Production Depreciation Calculator

- Depreciation Calculator (% per year)

- Accumulated Depreciation Calculator

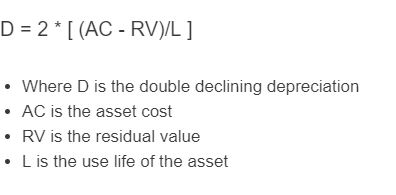

Double Declining Depreciation Formula

The following formula is used to calculate a double-declining depreciation.

D = 2 * [ (AC - RV)/L ]

- Where D is the double-declining depreciation

- AC is the asset cost

- RV is the residual value

- L is the useful life of the asset

Asset cost is the monetary value or price associated with acquiring or producing an asset.

Residual value refers to the estimated worth of an asset at the end of its useful life or lease term.

The useful life of an asset refers to the estimated period in which the asset is expected to be economically beneficial and used by the owner.

Double Declining Depreciation Definition

Double declining depreciation is a method used to calculate the depreciation expense of an asset, where the asset is assumed to lose value at a faster rate in the earlier years of its useful life. This method allows businesses to allocate higher depreciation expenses upfront, reflecting the higher wear and tear on the asset during its early years. It is important as it helps accurately account for the declining value of assets over time, allowing businesses to measure their true costs and make informed decisions regarding asset replacement or disposal.

When is a double-declining depreciation used?

A double-declining depreciation is most often used for assets that lose value quickly. Since the double-declining method depreciates an asset twice as fast as the straight-line method, it's useful to use this method when analyzing or considering assets that lose value quickly suck as machines that deteriorate quickly over time.

Does double-declining depreciation use salvage value?

The double-declining depreciation method does still use salvage value in its equation. This can be seen in the formula presented above. Even though the asset being analyzed most likely depreciates quickly, that does not mean the asset has no salvage value at the end of its useful life.

Why do companies use the double-declining depreciation method?

A company will use a double-declining method when the asset they have loses value faster than a typical asset they own. They also may use the double-declining method when they want to realize the depreciation of the asset sooner than later. Since depreciation can be written off on taxes, if a company has a financial reason to save on some taxes now instead of later, they could use this method.

How to calculate a double-declining depreciation?

- First, determine the total cost of the asset. This is should be the initial cost and the maintenance costs over its lifetime.

- Next, determine the residual value. Determine the value of the asset after its useful life.

- Next, determine the total useful lifetime in years.

- Finally, calculate the yearly double-declining depreciation.

FAQ

A double-declining deprecation is an accelerated model used in accounting to measure the depreciation of an asset. It doubles the typical straight-line deprecation.

This is used in business so that companies can account for worst-case scenario deprecation and allocate resources accordingly.