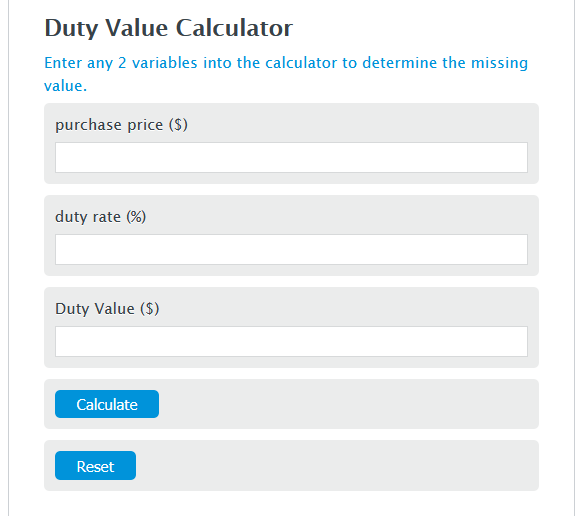

Enter the purchase price ($) and the duty rate (%) into the Calculator. The calculator will evaluate the Duty Value.

Duty Value Formula

DV = PP * DR/100

Variables:

- DV is the Duty Value ($)

- PP is the purchase price ($)

- DR is the duty rate (%)

To calculate Duty Value, multiply the purchase price by the duty rate.

How to Calculate Duty Value?

The following steps outline how to calculate the Duty Value.

- First, determine the purchase price ($).

- Next, determine the duty rate (%).

- Next, gather the formula from above = DV = PP * DR/100.

- Finally, calculate the Duty Value.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

purchase price ($) = 3003240

duty rate (%) = 23

FAQ

What is a duty rate?

A duty rate is a percentage that is applied to the value of imported goods. It is a type of tax imposed by a government on the import and, sometimes, export of goods.

How can I find the duty rate for a specific product?

Duty rates vary by country and product. They can be found in the Harmonized Tariff Schedule for the country into which the goods are being imported. Many countries provide online tools to help find these rates.

Are there any goods exempt from duty?

Yes, certain goods may be exempt from duty depending on the country’s laws. This can include items like certain types of books, personal effects, or items below a certain value. It’s important to check the specific regulations of the importing country.

What happens if I declare the wrong purchase price or duty rate?

Incorrectly declaring the purchase price or duty rate can lead to penalties, including fines or seizure of the goods. It’s critical to accurately declare all information to customs authorities.