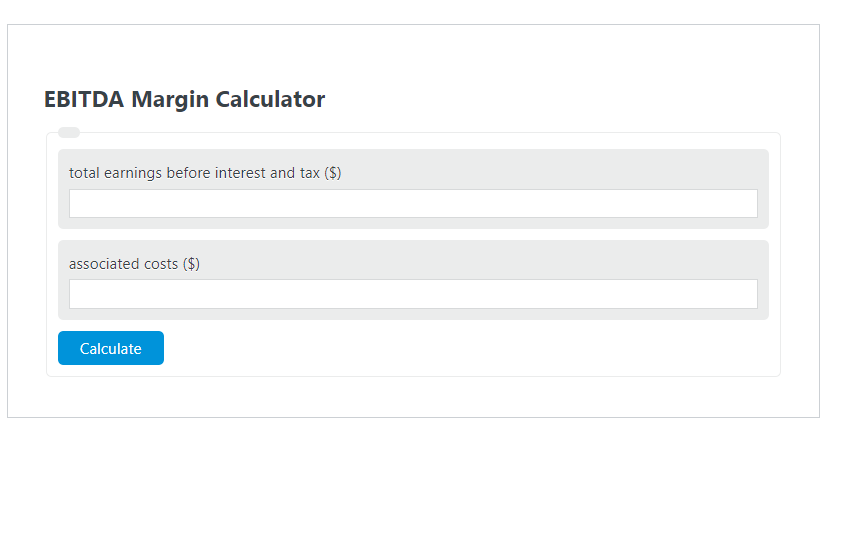

Enter the total earnings before interest and tax ($) and the total associated costs ($) into the EBITDA Margin Calculator. The calculator will evaluate and display the EBITDA Margin.

EBITDA Margin Formula

The following formula is used to calculate the EBITDA Margin.

EM = (EBITDA - AC) / EBITDA * 100

- Where EM is the EBITDA Margin (%)

- EBITDA is the total earnings before interest and tax ($)

- AC is the total associated costs ($)

How to Calculate EBITDA Margin?

The following example problems outline how to calculate EBITDA Margin.

Example Problem #1:

- First, determine the total earnings before interest and tax ($).

- The total earnings before interest and tax ($) is given as: 134.

- Next, determine the total associated costs ($).

- The total associated costs ($) is provided as: 50.

- Finally, calculate the EBITDA Margin using the equation above:

EM = (EBITDA – AC) / EBITDA * 100

The values given above are inserted into the equation below and the solution is calculated:

EM = (134 – 50) / 134* 100 = 62.68 (%)

FAQ

What is EBITDA and why is it important?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It’s a measure used to evaluate a company’s operating performance. It’s important because it removes the effects of financing and accounting decisions, providing a clearer view of a company’s operational profitability and cash flow.

How can the EBITDA Margin help investors?

The EBITDA Margin, expressed as a percentage, shows how much operating cash flow a company generates as a proportion of its revenue. It helps investors assess the financial health and efficiency of a company, comparing profitability among companies and industries by eliminating the effects of financing and accounting decisions.

Are there any limitations to using EBITDA Margin as a financial metric?

Yes, there are limitations. While EBITDA Margin can provide valuable insights into a company’s operational efficiency, it does not account for the cost of capital investments like property, plant, and equipment. This can sometimes give an inflated view of a company’s financial health, especially for capital-intensive industries. Additionally, it ignores changes in working capital and cash flow timing differences.