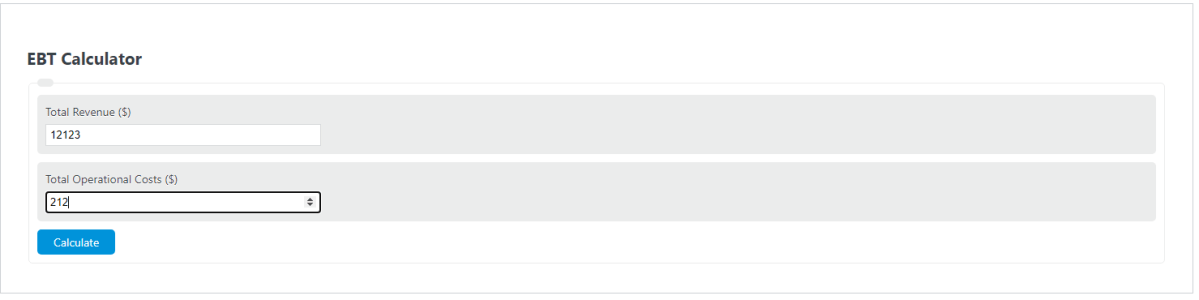

Enter the total revenue and total operating costs into the calculator to determine the earnings before tax (EBT).

- EBITDA Calculator

- Degree of Operating Leverage Calculator (+ Formula)

- OCF (Operating Cash Flow) Calculator

- Average Revenue Calculator

EBT Formula

The following formula is used to calculate the earnings before tax:

EBT = R - OC

- Where EBT is the earnings before tax

- R is the total revenue generated ($)

- OC is the total cost of operations ($)

To calculate the earnings before tax, subtract the total cost of operations from the total revenue.

EBT Definition

What is EBT?

EBT, short for earnings before tax (also commonly referred to as EBIT or earnings before interest and tax), is a term used in business to describe the total amount of profit made from a business before taxes are taken.

Example Problem

How to calculate EBT?

- First, determine the total revenue earned for the business.

For this example, the total revenue is given as $50,000.00.

- Next, determine the total costs during the same time period.

This is typically all operational and direct costs associated with the business. In this case, the costs were $30,000.00.

- Finally, calculate the EBT using the formula.

Using the formula above, the EBT is calculated to be:

EBT = R – OC

EBT = $50,000 – $30,000

EBT = $20,000

FAQ

What does EBT indicate about a company’s financial health?

EBT (Earnings Before Tax) provides insight into a company’s operational efficiency by showing how much profit it makes before paying income taxes. It helps investors and analysts assess the company’s profitability without the impact of its tax strategy.

How does EBT differ from EBITDA?

While EBT focuses on earnings before taxes, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) goes further by excluding not only taxes but also interest, depreciation, and amortization from earnings. This provides a clearer view of a company’s operating performance and cash flow.

Can a company have a positive EBT and still incur a net loss?

Yes, a company can have a positive EBT and incur a net loss if its tax expenses, interest payments, or other non-operational expenses exceed its earnings before taxes.

Why is calculating EBT important for businesses?

Calculating EBT is crucial for businesses to understand their profitability before tax obligations. It helps in making strategic decisions regarding cost management, pricing strategies, and operational adjustments to improve profitability.