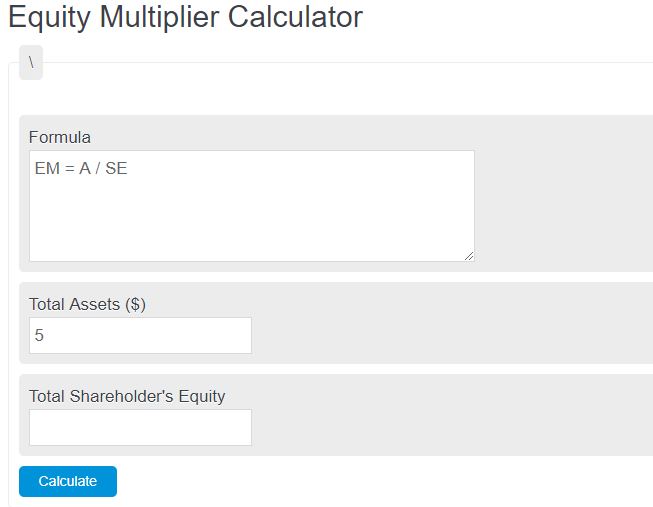

Enter the total amount of assets and the total amount of stockholder’s equity. The calculator will determine the equity multiplier.

- Debt to Equity Ratio Calculator

- Cost of Equity Calculator

- Return on Equity Calculator

- Shareholders Equity Calculator

Equity Multiplier Formula

The following equation can be used to calculate an equity multiplier.

EM = A / SE

- Where EM is the equity multiplier

- A is the total assets

- SE is the stockholder’s equity

Total assets are the sum of all tangible and intangible possessions owned by an individual, organization, or entity.

Stockholder’s equity is the residual interest in the assets of a company after deducting liabilities, representing the shareholders’ ownership in the company.

Equity Multiplier Definition

The equity multiplier is a financial ratio that measures the extent to which a company relies on debt financing to fund its assets. It is calculated by dividing total assets by total equity.

Equity multiplier is important because it helps assess a company’s leverage or risk level. A higher equity multiplier indicates that a larger portion of the company’s assets is financed through debt, which can increase financial risk. On the other hand, a lower equity multiplier suggests a lower reliance on debt and a stronger financial position.

By understanding the equity multiplier, investors and analysts can evaluate a company’s ability to meet its debt obligations and make informed decisions regarding its investment or creditworthiness.

Equity Multiplier Example

How to calculate an equity multiplier?

- First, determine the total assets.

Determine the value of all of the assets of a company.

- Next, determine the total stock holder’s equity.

Calculate the total value of the stock holder’s equity.

- Finally, calculate the equity multiplier.

Calculate the equity multiplier with the equation above.

FAQ

How does an equity multiplier relate to a company’s financial health?The equity multiplier is an indicator of a company’s leverage. A higher multiplier suggests greater use of debt in financing, which could mean higher risk. Conversely, a lower multiplier indicates less reliance on debt, potentially signaling a stronger, less risky financial position.

Can the equity multiplier vary significantly between industries?Yes, the equity multiplier can vary widely between industries due to differing capital structures and financing needs. Industries that require large capital expenditures, like manufacturing, might have higher multipliers, while service-oriented industries might have lower multipliers.

What is the impact of a high equity multiplier on investors?A high equity multiplier can be a red flag for investors, indicating high levels of debt and potential financial instability. However, it can also suggest high potential returns on equity, provided the company effectively manages its debt and assets.

How can a company improve its equity multiplier?A company can improve its equity multiplier by reducing its reliance on debt financing, either by paying off existing debt or by increasing its equity through retained earnings or issuing new stock. This results in a stronger, more stable financial base.