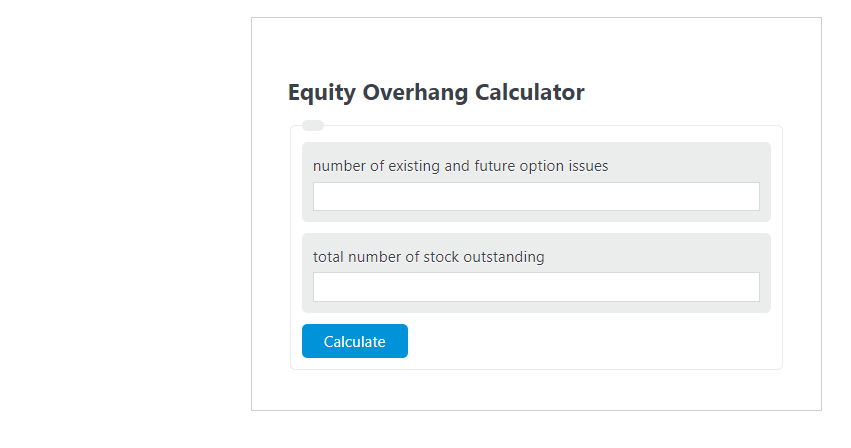

Enter the number of existing and future option issues and the total number of stock outstanding into the Equity Overhang Calculator. The calculator will evaluate the Equity Overhang.

Equity Overhang Formula

The following two example problems outline the steps and information needed to calculate the Equity Overhang.

EO = EFO / S

Variables:

- EO is the Equity Overhang ( )

- #EFO is the number of existing and future option issues

- #S is the total number of stock outstanding

To calculate the equity overhand, divide the number of existing option issues by the number of stocks outstanding.

How to Calculate Equity Overhang?

The following steps outline how to calculate the Equity Overhang.

- First, determine the number of existing and future option issues.

- Next, determine the total number of stock outstanding.

- Next, gather the formula from above = EO = #EFO / #S.

- Finally, calculate the Equity Overhang.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

number of existing and future option issues = 50,000

total number of stock outstanding = 100,000

EO = #EFO / #S = ?