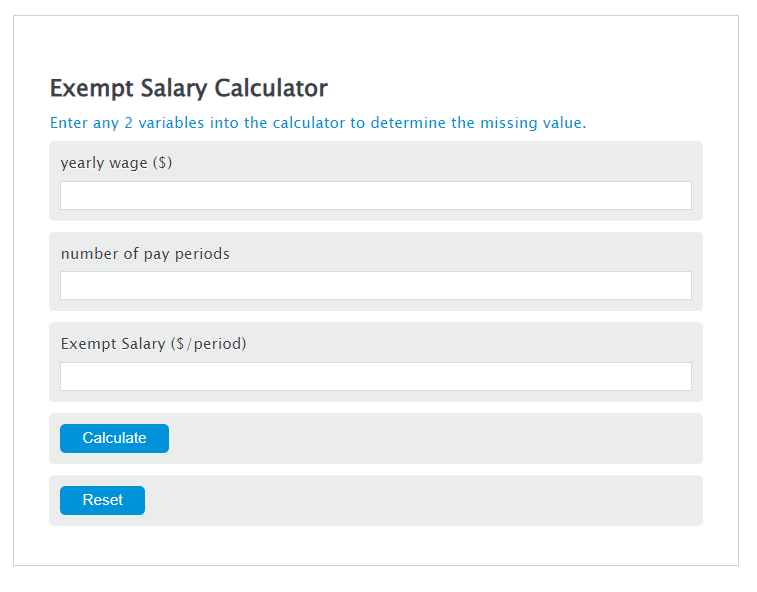

Enter the yearly wage ($) and the number of pay periods into the Calculator. The calculator will evaluate the Exempt Salary.

Exempt Salary Formula

ES = YW / PP

Variables:

- ES is the Exempt Salary ($/period)

- YW is the yearly wage ($)

- PP is the number of pay periods

To calculate the Exempt Salary, divide the yearly wage by the number of exempt pay periods.

How to Calculate Exempt Salary?

The following steps outline how to calculate the Exempt Salary.

- First, determine the yearly wage ($).

- Next, determine the number of pay periods.

- Next, gather the formula from above = ES = YW / PP.

- Finally, calculate the Exempt Salary.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

yearly wage ($) = 40000

number of pay periods = 52

Frequently Asked Questions (FAQ)

What is an Exempt Salary?

Exempt Salary refers to the compensation structure for employees who are exempt from earning overtime pay according to the Fair Labor Standards Act. These employees receive a fixed salary regardless of the number of hours worked.

How does the number of pay periods affect Exempt Salary?

The number of pay periods affects the amount of salary an employee receives per paycheck. More pay periods mean smaller amounts per check, while fewer pay periods result in larger amounts per check, but the total yearly salary remains the same.

Can Exempt Salary calculations be used for part-time employees?

Typically, Exempt Salary calculations are used for full-time salaried employees. Part-time employees are often paid based on the actual hours worked and may not fall under the exempt category.

What is the significance of using calculators like the Per Check Salary Calculator?

Calculators like the Per Check Salary Calculator help individuals and employers accurately determine the amount of money that should be paid each pay period, ensuring transparency and consistency in compensation practices.