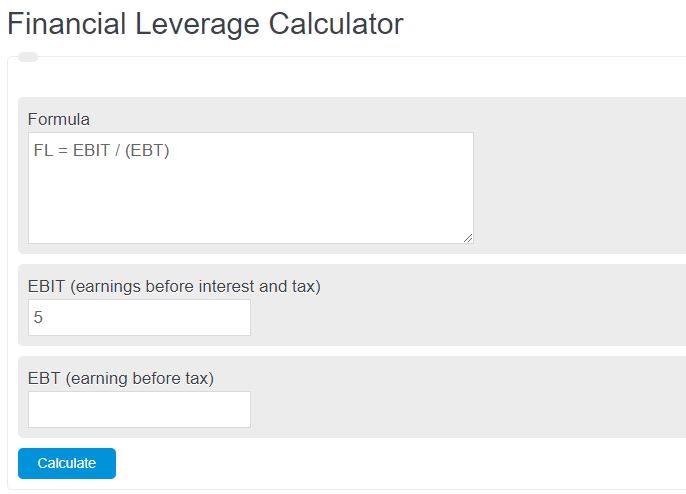

Enter the total EBIT and EBIT minus interest into the calculator. The calculator will evaluate and display the financial leverage.

- Degree of Operating Leverage Calculator (+ Formula)

- Equity Multiplier Calculator

- EBITDA Calculator

- EBT (Earnings Before Tax) Calculator

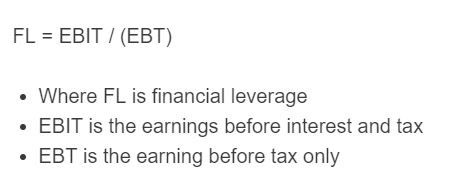

Financial Leverage Formula

The following equation can be used to calculate the financial leverage of a company.

FL = EBIT / (EBT)

- Where FL is financial leverage

- EBIT is the earnings before interest and tax

- EBT is the earning before tax only

To calculate the financial leverage, divide the earnings before interest and tax by the earnings before tax only.

Financial Leverage Definition

Financial leverage is a metric that describes how well a company performs relative to its interest earnings. In other words, the ratio of EBIT to EBT.

Financial Leverage Example

How to calculate financial leverage?

- First, determine the EBIT.

Measure the total earnings before interest and tax.

- Next, determine the EBT.

Measure the total earnings before tax only.

- Finally, calculate the financial leverage.

Calculate the financial leverage using the equation above.

FAQ

Why is financial leverage important for a company?

Financial leverage is important because it helps investors and analysts understand how a company uses debt to finance its operations and grow. A higher leverage can indicate a company’s reliance on debt, which may increase its risk, but also potentially its returns.

How does financial leverage affect a company’s profitability?

Financial leverage can affect a company’s profitability by increasing its potential returns on investment through the use of borrowed funds. However, it also increases the risk of loss if the company’s investments do not yield a higher return than the cost of debt.

Can financial leverage change over time?

Yes, a company’s financial leverage can change over time due to changes in its debt levels, operational earnings (EBIT), and overall financial strategy. Companies may adjust their leverage in response to market conditions and their financial health.

Is a higher financial leverage ratio always bad?

Not necessarily. A higher financial leverage ratio indicates more debt, but it’s not inherently bad if the company can effectively manage and utilize the debt to generate higher returns. The key is whether the increased risk is matched by potential for higher returns.