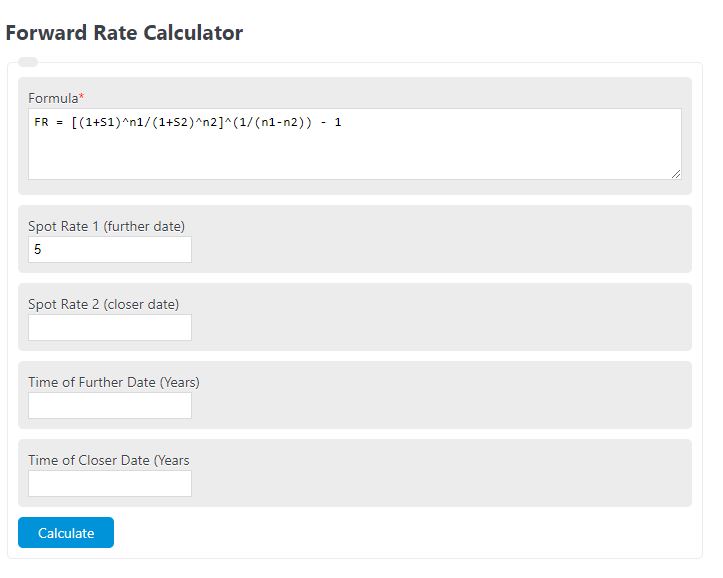

Enter the spot rate until a further future date and until a closer future date, and the number of years until a further date and the number of years until a closer future date to determine the forward rate.

Forward Rate Formula

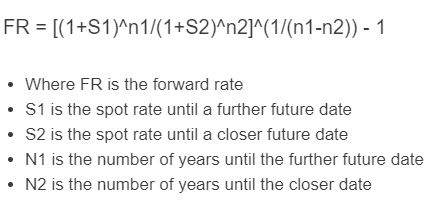

The following formula is used to calculate a forward rate.

FR = [(1+S1)^n1/(1+S2)^n2]^(1/(n1-n2)) – 1

- Where FR is the forward rate

- S1 is the spot rate until a further future date

- S2 is the spot rate until a closer future date

- N1 is the number of years until the further future date

- N2 is the number of years until the closing date

Forward Rate (finance) Definition

A forward rate in finance is the predetermined exchange rate for a future currency transaction. It represents the rate at which one currency can be exchanged for another at a specific time in the future.

This type of rate is commonly used in international trade and investment to mitigate the risk arising from exchange rate fluctuations.

By utilizing forward rates, businesses and investors can establish contracts or agreements to exchange currencies at a fixed rate on a specified future date. This allows them to hedge against potential losses resulting from unfavorable currency movements.

Forward Rate Example

How to calculate a forward rate?

- First, determine the spot rates at the two different time periods.

For this example, we will say the spot rates are .10 for the shorter time and .15 for the longer time.

- Next, determine the two time periods.

We will say the time periods are 10 and 15 years respectively.

- Finally, calculate the forward rate.

Using the formula we find the forward rate to be .257.

FAQ

How do forward rates help in financial planning and risk management?

Forward rates are instrumental in financial planning and risk management by providing a mechanism to lock in borrowing or lending rates, hedge against interest rate or currency fluctuations, and forecast future financial positions. This certainty in future rates can help businesses and investors make more informed decisions regarding their investments, loans, and other financial commitments.

Can forward rates predict future interest rates accurately?

While forward rates can provide an indication of market expectations for future interest rates, they are not always accurate predictors. Factors such as changes in monetary policy, economic indicators, and unforeseen market events can affect actual future rates. Thus, forward rates should be viewed as a tool for estimation rather than a definitive forecast.

What is the difference between a forward rate and a spot rate?

The primary difference between a forward rate and a spot rate is the time when the exchange rate is applied. A spot rate is the current exchange rate for immediate transactions, while a forward rate is an agreed-upon exchange rate for transactions that will occur at a specific future date. This distinction allows individuals and businesses to hedge against future currency risk by locking in rates.

Are there any risks associated with using forward rates in international trade?

While using forward rates can mitigate the risk of currency fluctuations, there are still risks involved. These include the counterparty risk, where the other party may fail to honor the contract, and the opportunity cost of potentially missing out on favorable rate movements. Additionally, forward contracts typically require a deposit or margin, which can tie up capital.