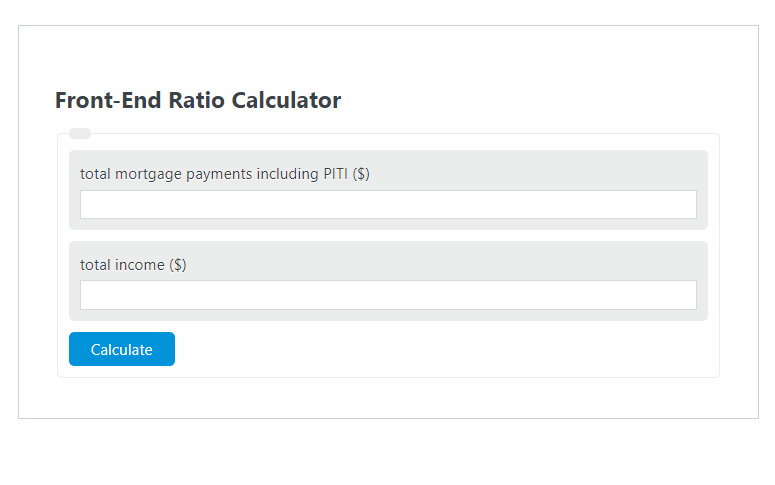

Enter the total mortgage payments, including PITI ($) and the total income ($) into the Front-End Ratio Calculator. The calculator will evaluate and display the Front-End Ratio.

- All Ratio Calculators

- Mortgage to Income Ratio Calculator

- Rent to Income Ratio Calculator

- Income Rent Ratio Calculator

Front-End Ratio Formula

The following formula is used to calculate the Front-End Ratio.

FER = M / I * 100

- Where FER is the Front-End Ratio (%)

- M is the total mortgage payments including PITI ($)

- I is the total income ($)

To calculate the front-end ratio, divide the mortgage payments by the total income, then multiply by 100 to express the result as a percent.

How to Calculate Front-End Ratio?

The following example problems outline how to calculate Front-End Ratio.

Example Problem #1:

- First, determine the total mortgage payments including PITI ($).

- The total mortgage payments including PITI ($) is given as: 3,000.

- Next, determine the total income ($).

- The total income ($) is provided as: 10,000.

- Finally, calculate the Front-End Ratio using the equation above:

FER = M / I * 100

The values given above are inserted into the equation below and the solution is calculated:

FER = 3,000 / 10,000 * 100 = 30.00 (%)

FAQ

What does PITI stand for in mortgage payments?

PITI stands for Principal, Interest, Taxes, and Insurance. It represents the total monthly obligations homeowners have when paying back a mortgage. This includes the loan’s principal and interest payments, property taxes, and homeowner’s insurance.

Why is the Front-End Ratio important for homebuyers?

The Front-End Ratio is crucial for homebuyers because it helps lenders determine a borrower’s financial capability to manage monthly housing expenses. A lower Front-End Ratio indicates that a smaller portion of income goes towards housing costs, making it easier for individuals to qualify for a mortgage.

What is considered a good Front-End Ratio?

A good Front-End Ratio typically falls at or below 28%. This means that no more than 28% of your gross monthly income should go towards your mortgage payment, including PITI. Lenders use this benchmark to ensure borrowers have enough income left for other expenses after paying their mortgage.