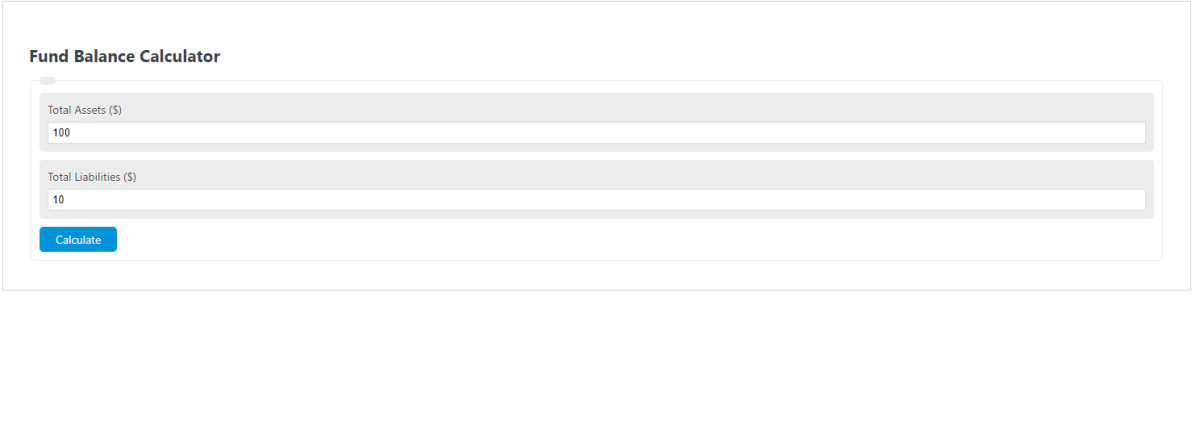

Enter the total assets value and total liabilities value into the calculator to determine the fund balance.

Fund Balance Formula

The following equation is used to calculate the Fund Balance.

FB = TA - TL

- Where FB is the fund balance ($)

- TA is the fund assets ($)

- TL is the fund liabilities ($)

To calculate the fund balance, simply subtract the fund liabilities from the fund assets.

What is a fund balance?

Fund balance refers to the difference between an individual’s investments and his or her liabilities. It is often used by financial professionals as a way of describing an individual’s net worth.

Fund balance is also known as net worth. Tangible assets like property, vehicles, and collections are included in the fund balance. The only asset not included in the fund balance is intangible assets such as stocks and bonds, which are considered liabilities because they require an investment of money and future earnings to acquire.

Ways you can increase your fund balance include saving money, investing in real estate, and planning for retirement. Ways you can decrease your fund balance include spending money on expensive items, gambling and other types of risky behavior, and using credit cards.

To find out what your fund balance is, add up all of your savings and investments (including retirement accounts like 401k) then subtract your debt (such as mortgages, car loans, credit card debt). If the end result is positive, you have a strong fund balance; if it is negative, you have a weak fund balance or a negative fund balance.”

How to calculate fund balance?

Calculating the fund balance is a basic function of accounting. It is a company’s assets minus its liabilities. If a company is unable to meet its financial obligations, it can go bankrupt. The fund balance is an important number that can be used to gauge the financial health of the company.

The following formula can be used to calculate the fund balance:

Fund Balance = Total Assets – Total Liabilities

The fund balance is also referred to as net assets or working capital. Depending on the type of business, the fund balance may have a negative value because of cash flow problems. The fund balance may also have a positive value in cases where cash flow problems are not present.