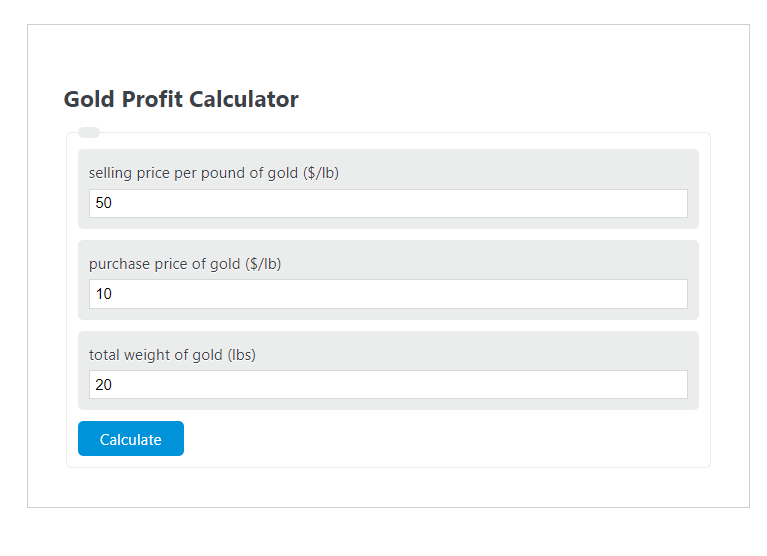

Enter the selling price per pound of gold ($/lb), the purchase price of gold ($/lb), and the total weight of gold (lbs) into the calculator to determine the Gold Profit Calculator.

- All Profit Calculators

- Product Profit Calculator

- Tax On Profit Calculator

- Gold Cost Per Pound Calculator

Gold Profit Formula

The following formula is used to calculate the Gold Profit Calculator.

GP = (SPG - PPG) * W

- Where GP is the Gold Profit Calculator ($)

- SPG is the selling price per pound of gold ($/lb)

- PPG is the purchase price of gold ($/lb)

- W is the total weight of gold (lbs)

How to Calculate Gold Profit?

The following example problems outline how to calculate Gold Profit.

Example Problem #1

- First, determine the selling price per pound of gold ($/lb). In this example, the selling price per pound of gold ($/lb) is given as 50 .

- Next, determine the purchase price of gold ($/lb). For this problem, the purchase price of gold ($/lb) is given as 20 .

- Next, determine the total weight of gold (lbs). In this case, the total weight of gold (lbs) is found to be 150.

- Finally, calculate the Gold Profit using the formula above:

GP = (SPG – PPG) * W

Inserting the values from above yields:

GP = (50 – 20) * 150 = 4500 ($)

FAQ

What factors can affect the selling price of gold?

The selling price of gold can be influenced by various factors including market demand, inflation rates, currency values, mining costs, and geopolitical stability. Global economic conditions and central bank policies can also play significant roles in determining gold prices.

How can investors minimize risk when investing in gold?

Investors can minimize risk by diversifying their investment portfolio, staying informed about market trends and economic indicators, setting clear investment goals, and considering long-term investment strategies. It’s also advisable to invest in gold through reputable sources and consider different forms of gold investments such as physical gold, gold ETFs, and gold mining stocks.

Is it better to invest in physical gold or gold-related financial instruments?

The choice between investing in physical gold or gold-related financial instruments depends on the investor’s goals, risk tolerance, and investment strategy. Physical gold offers tangible assets but comes with storage and insurance costs. Gold-related financial instruments like ETFs and stocks offer easier liquidity and can provide exposure to gold prices without the need to store physical gold. Each option has its advantages and considerations, so investors should carefully evaluate their preferences and investment objectives.