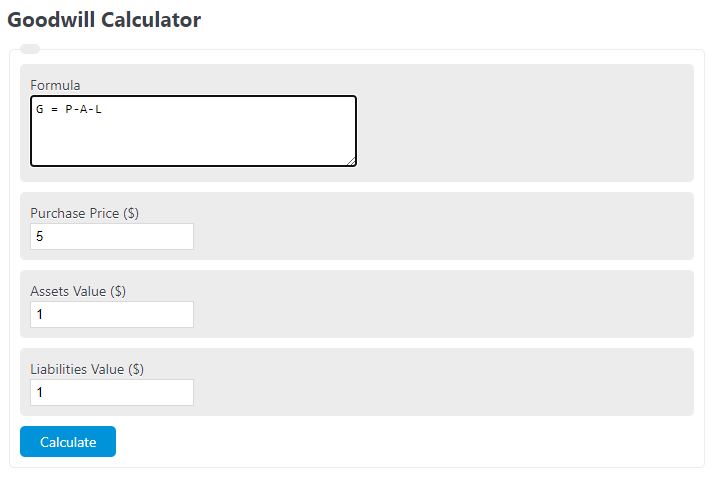

Enter the purchase price of a company, the fair market value of its assets, and the fair market value of its liabilities to determine the goodwill.

- Invested Capital Calculator

- Market to Book Value Calculator

- Net Fixed Assets Calculator

- Sales To Assets Ratio Calculator

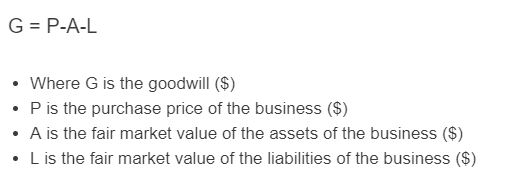

Goodwill Formula

The following formula is used to calculate a goodwill value.

G = P-A-L

- Where G is the goodwill ($)

- P is the purchase price of the business ($)

- A is the fair market value of the assets of the business ($)

- L is the fair market value of the liabilities of the business ($)

To calculate goodwill, subtract the fair market value of the assets and the fair market value of the liabilities from the purchase price.

Goodwill Definition

Goodwill is defined as the difference between the purchase price of a business and the fair market value of the business and its liabilities.

Goodwill Example

How to calculate good will?

- First, determine the purchase price of the business.

For this example we will say the business is purchased at $100,000.00

- Next, determine the value of the assets and liabilities associated with the business.

For this example we will say it as $50,000.00 worth of assets and $10,000.00 worth of liabilities.

- Finally, calculate the goodwill.

Using the formula we find the good will to be $40,000.00

FAQ

A good will is the theoretical value of an intangible asset associated with a company. For example, the “brand value” could be considered goodwill because it is not a tangible asset that can be bought or sold, but could hold intrinsic value if many people believe that brand to be good or trustworthy.