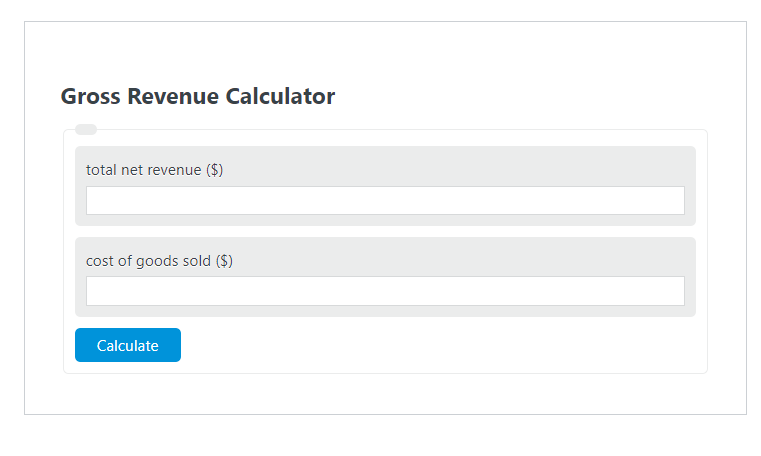

Enter the total net revenue ($) and the cost of goods sold ($) into the calculator to determine the Gross Revenue.

- All Revenue Calculators

- Net Revenue Calculator

- Annual Recurring Revenue Calculator

- Sales Revenue Calculator

Gross Revenue Formula

The following formula is used to calculate the Gross Revenue.

GR = NR + COGS

- Where GR is the Gross Revenue ($)

- NR is the total net revenue ($)

- COGS is the cost of goods sold ($)

To calculate the gross revenue, sum the net revenue and the cost of goods sold together.

How to Calculate Gross Revenue?

The following example problems outline how to calculate Gross Revenue.

Example Problem #1:

- First, determine the total net revenue ($). In this example, the total net revenue ($) is given as 56.

- Next, determine the cost of goods sold ($). For this problem, the cost of goods sold ($) is given as 20.

- Finally, calculate the Gross Revenue using the equation above:

GR = NR + COGS

The values given above are inserted into the equation below:

GR = 56 + 20 = 76 ($)

FAQ

What is the difference between Gross Revenue and Net Revenue?

Gross Revenue refers to the total amount of sales or income generated by a business before any expenses are subtracted. Net Revenue, on the other hand, is the amount of money that remains after all costs and expenses, including the cost of goods sold (COGS), have been deducted from the Gross Revenue. Essentially, Net Revenue gives a more accurate picture of a company’s profitability.

Why is the Cost of Goods Sold (COGS) important in calculating Gross Revenue?

The Cost of Goods Sold (COGS) represents the direct costs attributable to the production of the goods sold by a company. This includes the cost of the materials and labor directly used to create the product. COGS is important in calculating Gross Revenue because it helps determine the gross profit margin, which is Gross Revenue minus COGS. This figure is crucial for assessing the financial health and operational efficiency of a business.

Can Gross Revenue be a negative number?

No, Gross Revenue cannot be a negative number. Gross Revenue represents the total income earned by a company from its sales activities before any expenses are deducted. It is a measure of the total sales or service income and does not account for any costs or expenses. Therefore, by definition, it cannot be negative. If a company has no sales, the Gross Revenue would be zero, not negative.