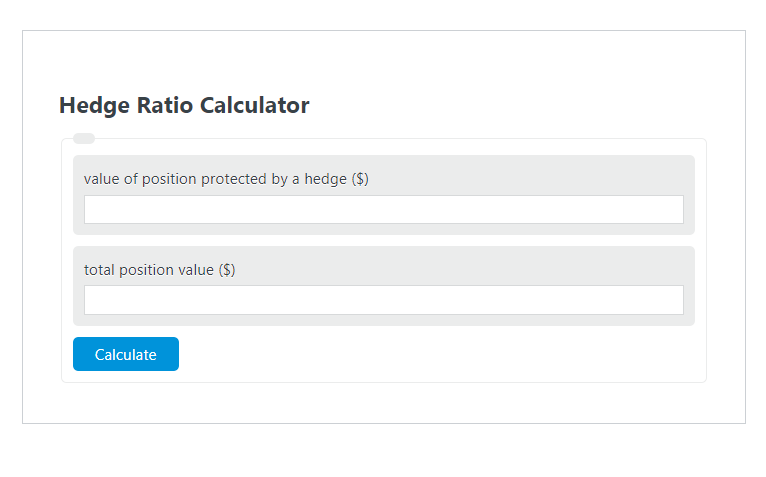

Enter the value of position protected by a hedge ($) and the total position value ($) into the Hedge Ratio Calculator. The calculator will evaluate and display the Hedge Ratio.

- All Ratio Calculators

- Return on Hedge Funds Calculator

- Plowback Ratio Calculator

- Time Interest Earned Ratio Calculator

Hedge Ratio Formula

The following formula is used to calculate the Hedge Ratio.

HGR = VP / TV *100

- Where HGR is the Hedge Ratio (%)

- VP is the value of the position protected by a hedge ($)

- TV is the total position value ($)

To calculate the hedge ratio, divide the value of the position protected by a hedge by the total position value.

How to Calculate Hedge Ratio?

The following example problems outline how to calculate Hedge Ratio.

Example Problem #1:

- First, determine the value of position protected by a hedge ($).

- The value of position protected by a hedge ($) is given as: 15,000.

- Next, determine the total position value ($).

- The total position value ($) is provided as: 50,000.

- Finally, calculate the Hedge Ratio using the equation above:

HGR = VP / TV *100

The values given above are inserted into the equation below and the solution is calculated:

HGR = 15,000 / 50,000 *100 = 30 (%)

FAQ

What is a Hedge Ratio?

A Hedge Ratio is a financial metric used to calculate the proportion of a position’s value that is protected (or hedged) against potential losses. It is expressed as a percentage, indicating how much of the total position is covered by a hedge.

Why is calculating the Hedge Ratio important?

Calculating the Hedge Ratio is crucial for investors and traders as it helps in managing risk. By knowing the percentage of a position that is hedged, one can make informed decisions about how to protect investments from market volatility and minimize potential losses.

Can the Hedge Ratio exceed 100%?

Yes, the Hedge Ratio can exceed 100% in cases where the value of the hedge exceeds the value of the position being protected. This situation might occur when an investor or trader opts for over-hedging to protect against extreme market movements or when the hedging instruments appreciate in value beyond the position’s value.