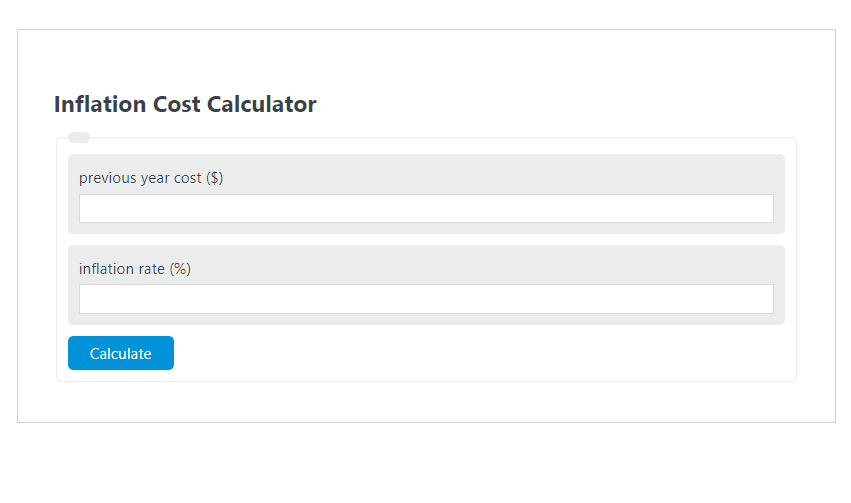

Enter the previous year’s cost ($) and the inflation rate (%) into the Inflation Cost Calculator. The calculator will evaluate and display the Inflation Cost.

- All Cost Calculators

- Inflation Premium Calculator

- Variance Inflation Factor Calculator

- Salary Inflation Calculator

Inflation Cost Formula

The following formula is used to calculate the Inflation Cost.

IC = PC * IR/100

- Where IC is the Inflation Cost ($)

- PC is the previous year’s cost ($)

- IR is the inflation rate (%)

To calculate the inflation cost, multiply the previous year’s cost by the inflation rate.

How to Calculate Inflation Cost?

The following example problems outline how to calculate Inflation Cost.

Example Problem #1:

- First, determine the previous year’s cost ($). The previous year cost ($) is given as 10,000.

- Next, determine the inflation rate (%). The inflation rate (%) is provided as 5.

- Finally, calculate the Inflation Cost using the equation above:

IC = PC * IR/100

The values given above are inserted into the equation below:

IC = 10,000 * 5/100 = 5,000.00 ($)

FAQ

What is inflation and how does it affect purchasing power?

Inflation is the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. Central banks attempt to limit inflation, and avoid deflation, in order to keep the economy running smoothly. As inflation increases, the value of money decreases, meaning that consumers can buy less with the same amount of money over time.

Why is it important to calculate inflation cost?

Calculating inflation cost is important for both individuals and businesses to understand how inflation will affect their expenses and purchasing power over time. This calculation helps in budgeting and financial planning, ensuring that savings and investments are adjusted to maintain or increase their value in the face of inflation.

Can the inflation rate vary by sector or industry?

Yes, the inflation rate can vary significantly by sector or industry. For example, technological advancements might lead to deflation in some sectors by reducing the cost of goods and services, while other sectors, such as healthcare or education, may experience higher rates of inflation due to increasing demand and other factors. Understanding these variations is crucial for businesses and investors when making strategic decisions.