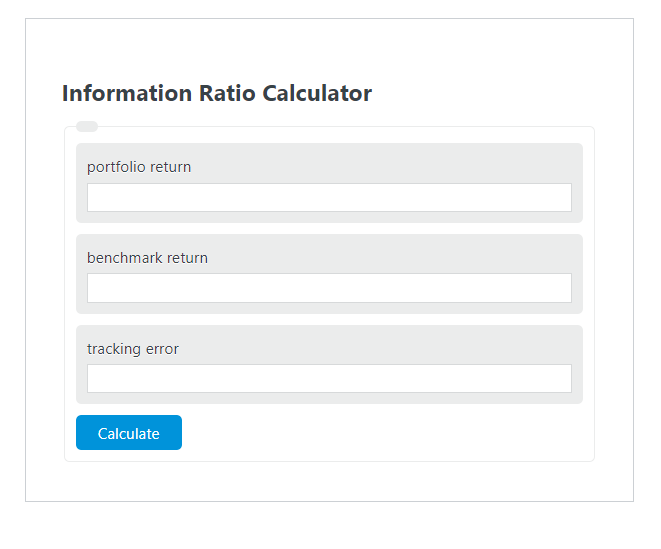

Enter the portfolio return, the benchmark return, and the tracking error into the Information Ratio Calculator. The calculator will evaluate and display the Information Ratio.

- All Ratio Calculators

- Risk-Adjusted Return Calculator

- Portfolio Margin Calculator

- Reward to Risk Ratio Calculator

Information Ratio Formula

The following formula is used to calculate the Information Ratio.

IR = (PR - BR) / TE

- Where IR is the Information Ratio ( )

- PR is the portfolio return

- BR is the benchmark return

- TE is the tracking error

To calculate the information ratio, divide the difference between the portfolio and benchmark returns by the tracking error.

How to Calculate Information Ratio?

The following example problems outline how to calculate Information Ratio.

Example Problem #1

- First, determine the portfolio return .

- The portfolio return is calculated to be : 5000.

- Next, determine the benchmark return.

- The benchmark return is measured to be: 3000.

- Next, determine the tracking error.

- The tracking error is found to be: .89.

- Finally, calculate the Information Ratio using the formula above:

IR = (PR – BR) / TE

The values given above are inserted into the equation below and the solution is calculated:

IR = (5000 – 3000) / .89 = 2247.19 ( )

FAQ

What is the significance of the Information Ratio in portfolio management?

The Information Ratio (IR) is a measure of portfolio returns beyond the returns of a benchmark, usually an index, relative to the volatility of those returns. It is significant in portfolio management as it helps in assessing the performance of a portfolio manager in generating excess returns compared to the market, adjusted for the risk taken through tracking error. A higher IR indicates a better risk-adjusted performance.

How does the Information Ratio differ from the Sharpe Ratio?

While both the Information Ratio (IR) and the Sharpe Ratio measure risk-adjusted returns, they differ in their benchmarks and applications. The Sharpe Ratio compares the excess return of an investment to its standard deviation, using a risk-free rate as a benchmark. In contrast, the IR uses a market index or a similar benchmark for comparison and focuses on the return relative to the tracking error. Essentially, the Sharpe Ratio assesses how well an investment compensates for the risk taken, whereas the IR evaluates the ability of a portfolio manager to generate excess returns over a benchmark.

Can the Information Ratio be negative, and what does it signify?

Yes, the Information Ratio can be negative. A negative IR indicates that the portfolio has underperformed its benchmark, taking into account the tracking error. This underperformance can be due to various factors, including poor investment decisions or adverse market conditions. A negative IR is a warning sign for investors and portfolio managers to reassess their investment strategies and risk management practices.